Articles

D1 Buy DAX

2455 November 10, 2017 02:51 AoFX Forex Signals DAX

DAX / GER30 / DE30

Buy from current price 13234

For enhancement Buy Limit 13179 13118 13047

SL 12882

TP1 13400 TP2 13550 TP3 13700 TP4 13850 TP5 14000

Full Article189 | +3.957% | 8 Setups

2388 November 9, 2017 16:17 SwingFish Trading Room Journal GBPJPY • GOLD • USDJPY

02:44 a VERY Early Thursday Session (i may trade later again, but can’t promise anything as i may be a bit busy today)

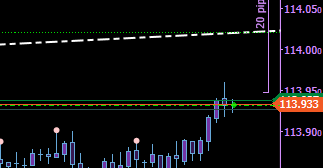

02:59Buying USDJPY

03:01Scaling in USDJPY and Buying GOLD for a quick jump up

03:05Close GOLDÂ Trade for a small gain.

03:18Closing USDJPY with a small gain (i had it hedged in between .. so this trade was about preserving Capital)

as the upper trendline was the original Target.

03:39Buying USDJPY again, which was stupid, as the price reached the upper trendline already.

also, the DXY at the vWap and Gold just fall back to the vWap as well.

as a result, Reversed USDJPY to Short (realizing a 1.2% loss) and Bought Gold.

03:47Close USDJPY Sell for a nice Profit.

03:47Close GOLD Buy as well with a small Profit

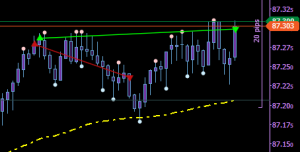

03:57Buy GBPJPY

03:57 price suddenly dropped on GBPJPY .. so I scaled in 2 times until it bounced off the vWap

04:14Closing all GBPJPY Trades, price surely going all the way to 149.42,

but at this time I will just take the profits and let it be. (feel not so confident)

### Stream Stops here ###

and just as promised .. price went right with the next candle all the way up to the Trendline.

11:14 some mass scalping parallel on GBPUSD, GBPJPY and USDJPY.

only the USDJPY trade worked out .. and paid for all the other hedged trades

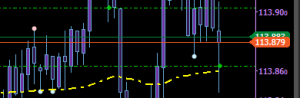

USDJPY very likely to fall to the 113.80 area.

11:52 wow that call went down really fast. “113.8 as promised”

Total Gain Today: 3.957%

Full Article

188 | +3.139% | 4 Setups

2354 November 8, 2017 16:41 SwingFish Trading Room Journal GOLD • USDJPY • USDSGD

10:41 Very late again this Wednesday

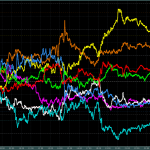

Today

Positive: JPY, CHFÂ

Negative:Â AUD, CAD, NZD

EUR and USD almost NeutralÂ

10:49Â Buying USDSGD

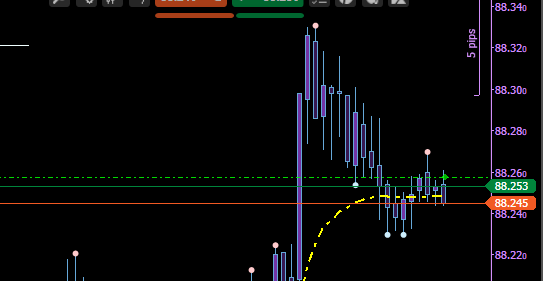

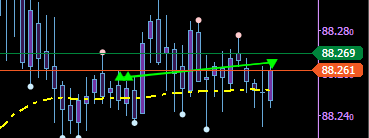

10:51 Hedging USDSGD as we too far from the vWap and Euro appears to be turning.

11:17 Good thing about the hedge.. the US Dollar Index is somewhat very undecided .. it basically can go anywhere from here. we wait for a little while

11:53 i may hold on to the USDSGD hedge a bit longer.

- the Triangle is just 7 pips wide. very hard to find an exit.

- other US-related Pairs moving upwards

- DXY is still below the vWap bouncing along the trendline

12:32 reversing USDSGD Short Hedge realizing 0.48% gain.

the situation is still a bit tricky .. DXY still below vWap

13:02 closing USDSGD buy early, hedge and original trades went out green pushing the account to a 2.7% Gain

14:01 instead of being smart, I was stupid .. and bought the reversal of USDJPY right before Frankfurt opening.

things can change quickly, and they did, hedged about 12 minutes later.

14:25 to make things worse .. reversed the hedge right at the DXY lower trendline.

i either run now into a huge loss or DXY breaks out downwards and we good … very stupid decision indeed.

15:42 closing all USDJPY Trades .. realizing 0.72% loss.

15:10 – 16:35 .. got me into a mess with GOLD.

closing it all out for now with a big loss

16:21 Buying GOLD for upper trendline Target

### Stream Stops here ###

17:59 SwingFish Helper closed all positions at Breakeven point

gaining 4.21% due to massive Positions and Momentum-Slippage.

20:38 Buying USDJPY on the Trendline Bounce,

additional confirmation as DXY did hit the vWap, so a small retracement was very sure, bought in a large position.

20:42 Closing USDJPYÂ gaining another 0.5% Equity.

Total Gain Today: 3.139%

Full Article

187 | +3.695% | 3 Setups (1.58% on a few Scalps)

2334 November 7, 2017 11:01 SwingFish Trading Room Journal AUDJPY • AUDNZD • AUDUSD • EURUSD

07:19 Very late again this Tuesday

Yesterdays expected USDollar move put some shaking in the Divergences .. but that is good for us day-traders, as this will be boiled out very soon, and the boiling out is where we make the $$

Today

Positive: GBP, NZD, AUD,Â

Negative:Â CHF, USD, EUR

Japanese Yen almost Neutral .. that’s a firstÂ

09:07 Quick Selling AUDUSD to make my mark in todays P/L

pretty much catching a falling knife, but its not falling at free fall, so it’s controllable for a quick scalp

09:12 closing AUDUSD Sell with a 0.959% gain

09:28Â thinking on buying AUDJPY .. looks very much sloping up.

09:31 Lucky, didn’t Buy it

09:44 Selling EURUSD

09:46 the EURUSD sell does not look so good now after entering comparing with USDollar Index

09:48 Hedging EURUSD with -2.6 pips

10:20 AUD News coming up. will use the volatility to scalp myself out of the EURUSD Hedge.

RBA Interest Rate Decision RBA Interest Rate Decision is announced by the Reserve Bank of Australia. If the RBA is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the AUD. Likewise, if the RBA has a dovish view on the Australian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

10:30 News is neutral .. but we are not interested in the results anyway,

just playing on the Volatility in the direction of the Divergences.

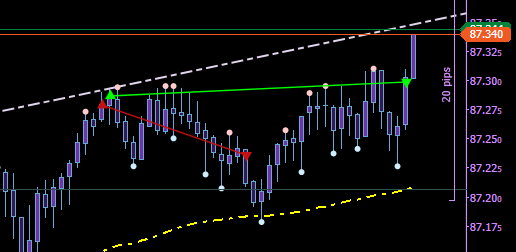

Buying AUDNZD .. and scaled in about 15 sec. later 100% after it dropped 12.3 pips.

10:33 hitting close all after AUDNZD Spikes up

AUDNZD it will very likely go up for at least another 20 pips, and then fall back to the vWap.

but we use this trade to pay for losses. Luckily slippage was on my side, resulting in a total gain of 2.138% for today.

Total Gain Today: 2.138% (grand Total today: +3.16%, with the scalps below)

### Live Stream ends here ###

as promised, AUDNZD retraced back 100% to the vWap just 40 Minutes later

it’s all just “Hot Air”

12:43 selling EURUSD for a quick fun-scalp

12:52 close EURUSD shorts gaining another 0.36% (this gain adds not to the stats .. was just for fun)

price likely to fall more to 1.16005 or even 1.580

15:11 another quick scalp on USDJPY (sorry could not resist)

Grand Total today: +3.695%, including the quick trades.

Full Article

186 | +2.18% | 3 Setups

2286 November 6, 2017 23:50 SwingFish Trading Room Journal AUDUSD • GBPCHF • GOLD

06:18 Morning everyone

NZD swang up massive resulting of Yesterdays night-spikes … its still unclear what caused that moe .. but there is some corrections be expected today or tomorrow.

Divergence data

Positive: GBP, EUR

Negative:Â JPY, CHF

06:23Â Buying AUDUSD

09:26 Scaling in 100% on AUDUSD Buy

09:31 did not work .. hedging with 3.3 pips .. not life-ending stuff, just a bad start.

06:52 place Buy Limit GBPCHF with a target of 36 pips .. (upper trendline)

06:56 delete Buy Limit on GBPCHF (better wait for Tokyo open)

06:57 reversing AUDUSD Hedge .. realizing a 2.14% loss

06:57 SwingFish Helper Algo did auto hedge just a few sec later .. as the price went down again.

10:04 closed with half the loss back in all AUDUSD trades as we reached the trendline.

10:09 got me in a Gold mess (sorry no entry screenshot)

hedged twice realized a tiny profit .. but account still down 1.54%

11:10 after a lot of up and downs .. I put a final 100% hedge on .. waiting for a better location.

still long bias .. but the USDollar does not cooperate.

11:15 meanwhile the GBPCHF trade which i did NOT take .. worked out well ..

11:21 reversing GOLD hedge to buy positions.

maybe not so good idea as we are right at the trendline now ..

16:20 .. going out .. gold trades are still on

set SwingFish helper to sell everything once P?L goes green

23:19 Swingfish Helper closes all Trades with good profit, adding a gain of 3.73%

Total Loss Today: 2.185%

Full Article

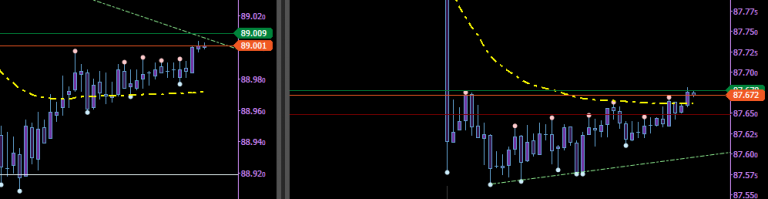

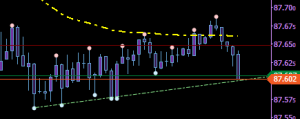

H4 Buy CADJPY

2307 November 6, 2017 03:00 AoFX Forex Signals CADJPY

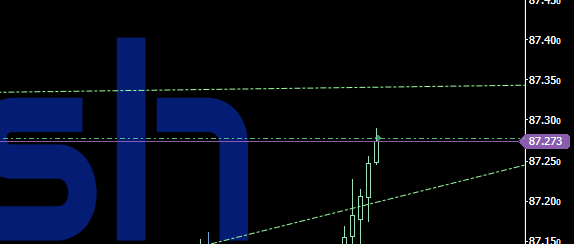

CADJPY Buy limit 89.19 89.01 88.89

SL 88.45

TP1 89.56 TP2 89.99 TP3 90.33 TP4 90.75

Full ArticleSwingFish Summary Week 44

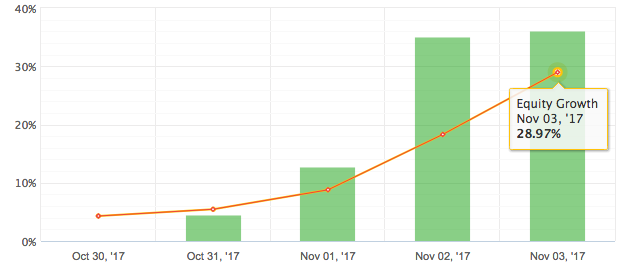

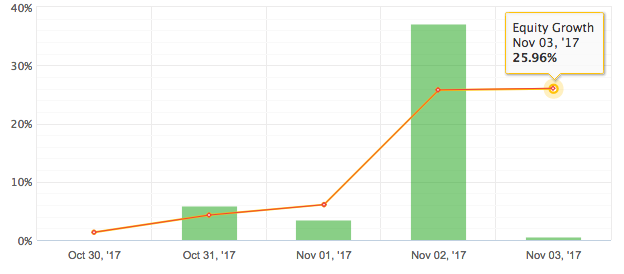

2292 November 4, 2017 11:32 SwingFish SwingFish Updates

Week 44 has been exceptionally productive!

SwingFish Weekly Payout for Risk-Free Plan: 0.35%

Top Gainers this week:

1000 (Chatroom/Live) account gaining +28.97% (no positions open)

UB-Noise Crashtest with +26.05% (carries a 0.07% equity drawdown into the weekend), total gain for this Year: +67.52%

mf-Crowd gaining +4.83% this week (carry another 4‘ish% gain into the weekend)

Total Gain this Year +80.04%.

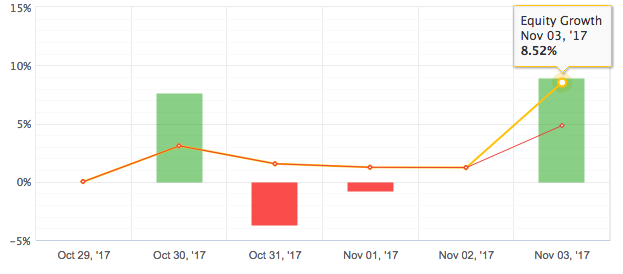

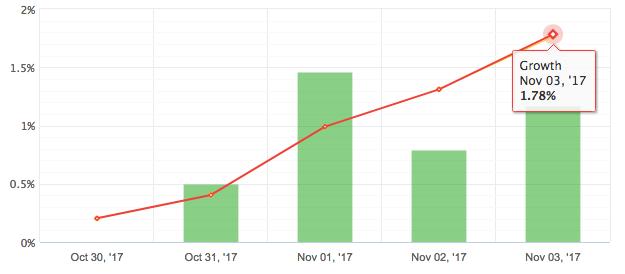

UB-Noise (GBPAUD) had a slow week with a gain of +1.78%, totalling this Year with +57.85%

we will withdraw 300$ from this account.

Chatroom & Yaser Analysis has still a alrge amount of active trades open .. only 1 where closed that gained +0.36%, totaling this Year +43.72%.

Full Article185 | +4.011% | 2 Setups

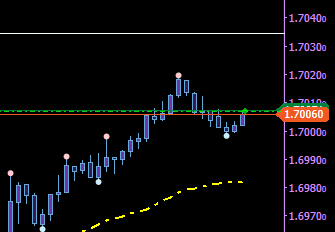

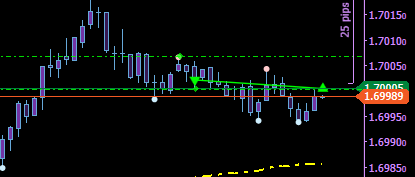

2249 November 3, 2017 14:19 SwingFish Trading Room Journal AUDUSD • GBPAUD

09:01 Morning everyone

NZD swang up massive resulting of Yesterdays night-spikes … it’s still unclear what caused that move (but I personally do care very little about it anyway) there are however some corrections be expected today or tomorrow.

Divergence data

Positive:Â CAD, EUR, CHF

MASSIVE Negative:Â GBP

will post a Pre-NFP Update later on Divergences data.

09:46Â quick Short Scalp AUDUSD to S1 (no other technical reason to do that, besides the momentum)

09:47 Price pulls back .. Closing AUDUSD Short scalp with 0.175% gain.

09:48 re-enter AUDUSD Short (i always want to trade the same price range twice .. )

09:57 exit re-short AUDUSD

got my Double trade at the same price, stop playing around now !!

got my Double trade at the same price, stop playing around now !!

will go take a shower, back in a little bit.

10:54 being bored, buying GBPAUD for a little bit up

was thinking of selling AUDJPY on the vWap for 7.5 pips

and buying CADJPY on the vWap for 5.5 pips but do not do it

11:06 hedging GBPAUD Buy.

it’s not yet out of the setup, but the position size is too large, so we take care of this a bit later when volatility is higher.

12:10 the CADJPY trade (which I did not take) worked out fine .. but the AUDJPY trade went slightly above vWap.

12:25 Closing GBPAUD Hedge for 0.18% profit, leaving the long position exposed on a 7pip gap.. (that could end up being expensive.

12:35 reversing GBPAUD again to be a Hedge, adding another 0,09% to the account.

It is likely to go up now to my original target 50’ish pips up, but this setup is not so clear yet.

12:40 .. the possible trade on AUDJPY did play out after all .. now both would have been green .. sad i did not really trade them.

13:05 Reverse GBPAUD Hedge to Buy .. double the position and risk

13:11 Closing all Positions with 4.011% total gain (i’m still convinced the original targets of 1.70341 – 1.70661 are still in play)

but I have to leave the house now.

### have to do School Run now, stopping stream here, we may have another NFP Session, later on ###

Full Article

you can make easy 500%

2259 November 3, 2017 02:01 SwingFish Traders Library

you can make easy 500% in profits …

and lose 100% of it in just the same time.

Full Article

184 | +8.743% | 4 Setups

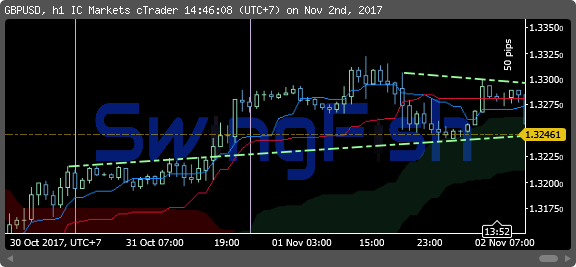

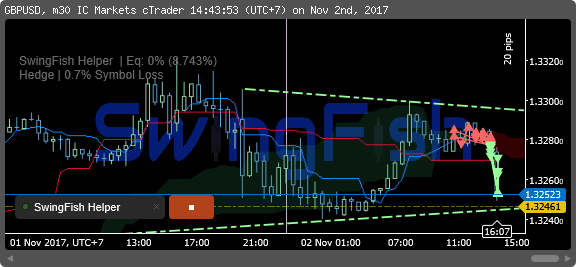

2205 November 2, 2017 15:08 SwingFish Trading Room Journal CADJPY • GBPJPY • GBPUSD

09:01 Morning everyone

NZD swang up massive resulting of Yesterdays night-spikes … its still unclear what caused that moe .. but there is some corrections be expected today or tomorrow.

Divergence data

Positive: AUD, CAD

Negative:Â GBP, JPY, CHF

09:03 quick CADJPY Scalp down for 3.4 pips .. did not work so well hedge placed just about 2 minutes later.

there is a high chance it may still fall .. but they may be an up-swing first, that’s why the hedge is the saver option.

09:16 Reversing hedge to buy CADJPY (double buy position)

09:26 Closing out all CADJPY positions with 0.552% total account gain. price may go up to 88.91 on CADJPY .. but this was a hedged Setup, so damage control first.

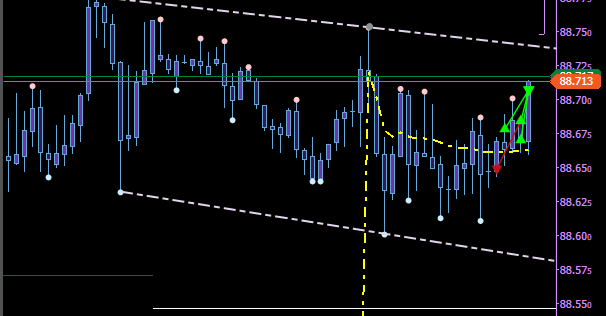

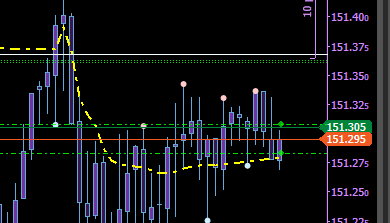

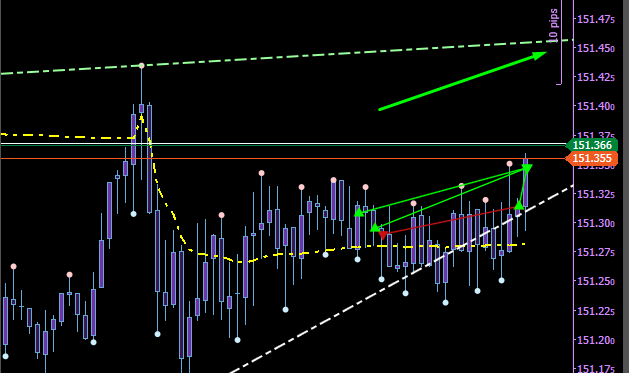

10:09 Buy GBPJPY and BuyLimit order GBPJPY on the vWap a few pips down to auto scale-in.

10:28 BuyLimit GBPJPY Filled (i may exit this one early once it’s paid for .. )

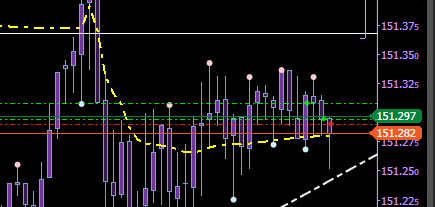

10:35 manually hedge the whole GBPJPY Position .. it swung down a lot, bias is still upwards with 151.451 as a goal

the position is too large for a swing down.

going to have Breakfast

11:50 Buying GBPUSD

11:55 Scaling in 50% on GBPUSD Buy while in loss

12:10 Hedging GBPUSD, waiting on both GBPJPY and GBPUSD for Frankfurt opening to get some short-term direction

12:32 Reverse GBPJPY Hedge. Realising 0.52% loss to the account. waiting for the hedge pays for the loss to exit.

12:43Â Closing GBPJPY to pay for hedged positions, adding 1.68% to the account (Total now: 1.467%)

the original target for that trade on GBPJPY was 151.451

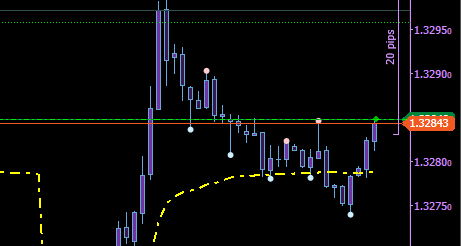

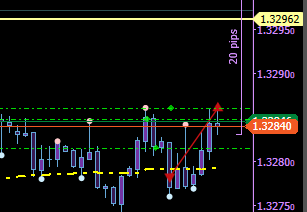

12:53 Reversing GBPUSD hedge in the middle of the field .. that could turn bad quickly the original target of 1.32962 is still in play

the reason was the dollar index appears to be continuing the way down, but that’s may more of an excuse

13:00 did not work out, hedging again 1.81% loss

off bring Wife to work .. let’s see what London has to offer later .. leave the hedge position on

14:21 Reversed everything downwards, added about 25% more to short positions .. targeting the trendline connects the waves on the 1 Hour Chart.

14:42 Closing all positions as there was a tiny pullback .. (the trendline maybe not correct)

have not looked the Gains while this trade was on .. and wow .. that last trade added MASSIVE to the account!

Closing up Today with a Total Gain of 8.743%

Full Article

H4 Sell EURNZD

2220 November 2, 2017 09:45 AoFX Forex Signals EURNZD

EURNZD Sell ??from current price 1.6871

For enhancement Sell ??Limit 1.6919 1.6962

SL 1.7073

TP1 1.6758 TP2 1.6633 TP3 1.6504 TP4 1.6363

Full Article183 | +3.164% | 4 Setups

2166 November 1, 2017 16:02 SwingFish Trading Room Journal AUDJPY • CADJPY • GOLD • USDJPY

09:40 good Tuesday Morning.

NZD swang up massive resulting of Yesterdays night-spikes … its still unclear what caused that moe .. but there is some corrections be expected today or tomorrow.

Divergence data

Positive: NZD, GBP

Negative:Â JPY, CAD

09:42 Buy AUDJPY

quick scalp for 5 pips upwards to the trendline from the M30 Chart

09:56 Buying CADJPY

maybe was not such a great idea .. as the correlation to AUDJPY will basically double the risk

10:09 sell GOLD

10:25 .. no trades closed yet

11:46 scaling out of AUDJPY Buy trade (sell back 92% of the position for a 0.632% Loss)

12:13 Closing CADJPY a tiny bit over breakeven.

12:13 as for AUDJPY Buy … “I’m going down with the ship !!” (at least till the 3€ blows)

12:53 Buy USDJPY

12:58 Scaling in USDJPY Buy with 40%

14:12 Closing AUDJPY Buy once it paid for the scale out

14:14 of course .. 2 minutes later it ran straight into my original TP level leaving a 0.6% gain in the market

15:00 scaling in on USDJPY Buy, that may be a massive mistake as the USDollar Index dramatically dropping, betting on opening volatility to seal the deal.

15.48 Closing GOLD buy trade with 1.9% Loss, as DXY starts to get some traction downwards, Gold may raise quickly.

the Nikkei, however, is still strong so we keep the USDJPY buy trade open. (USDJPY will pay for that one, hopefully)

15:55 Scaling in saved the day, closing all trades with 2.346% gain.

Total Gain Today 3.164%

Full Article