Articles

257 | +1.872% | 4 Setups

5042 February 14, 2018 15:51 SwingFish Trading Room Journal DAX • GBPJPY • GOLD • USDMXN

08:52 Good Yesterday was a very impressive day in matters of Nikkei and USDollar Movements .. causing USDJPY to fall almost 150 pips. so today is either a continuation or nothing happen at all. (more…)

(more…)

199 | +3.92% | 2 Setups

2789 November 23, 2017 02:01 SwingFish Trading Room Journal GOLD • USDMXN

00:22Â early morning session today.

170 | -2.92% | 3 Setups

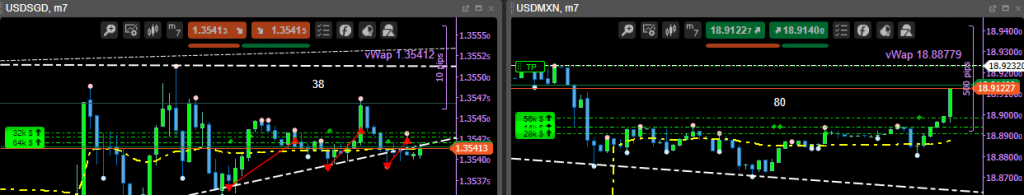

1541 October 13, 2017 19:56 SwingFish Trading Room Journal AUDJPY • USDMXN • USDSGD

Friday the 13th !! Yay 😉

09:42Â Starting late in the day today

divergences do look good for NZD, AUD versus EUR, CHF, CAD

The live-now link does not work on the website.

a live stream is running! you can check it out here https://www.youtube.com/c/SwingFish/live

09:45 Selling AUDJPY it may not work as it does look a bit choppy

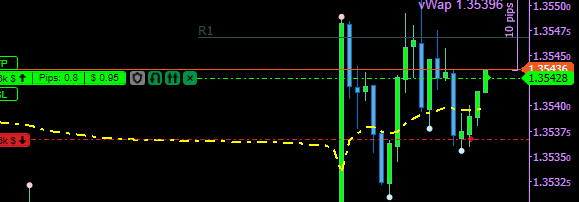

09:49 Selling USDSGD, also a bit tricky because of the massive movement before .. (hoping for a fade)

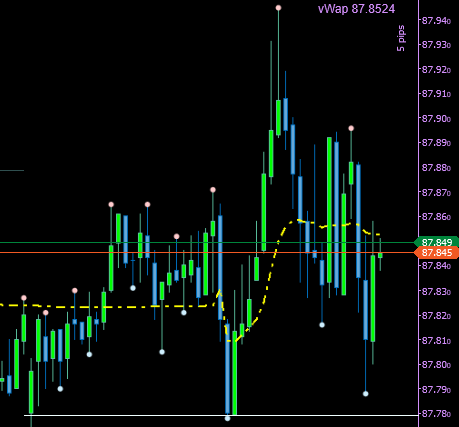

09:52 Selling USDMXN

09:57 USDMXN Auto-hedge active by SwingFish Helper (i think that was a bit too close (too large position size)

10:01 Manually hedged USDSGD .. because the visible momentum is still Bullish

10:06 turning off SwingFish Helper and reversing USDMXN Hedge to a Short trade.

10:25 Hedging AUDJPY as well .. not a good start in the day .. 3 “losers” in a row.

10:35 first Stupid decision of the day .. Reversing AUDJPY to Long based on the H1 chart

10:55 Reversing USDMXN and USDSGD to Long

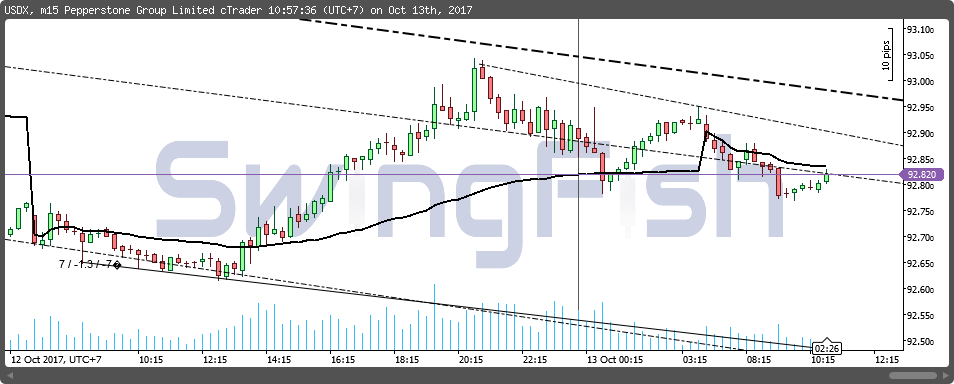

this may turn out as a mistake as the DXY just touching the vWap

11:04 exit the AUDJPY trade gaining 0.6% and pay for the failed hedge.

price probably goes much future. but well not feeling confident right now.

11:10 turning odd the SwingFish helper to allow more drawdown .. (placed counter orders).

gonna get off my desk for a moment.

12:26 pending hedge-orders on both USDSGD and USDMXN Filled.

they where likely placed too early on USDSGD

12:40 Fixed YouTube Livestream Icon on Main website

12:47 giving it a nother try to resolve the hedges on both USDSGD and USDMxN on the Long Side.

let’s see how that now works out, i have the feeling this will just be a VERY expensive trade set.

12:59 getting ready to pull the plug, just in case Frankfurt Pre Market decides to turn the USDollar around

13:16 Closing USDMXN with 3% profit .. still down overall

13:25 Frankfurt Pre market had not enough Volume.. place another hedge on USDSGD and wait for Cash Market to open.

as of now, I think USDollar will go down a little bit more

15:37 Hedging the last USDSGD Long trade as the USDollar maybe just made a Fakeout.

Price will very likely go up to the trendline .. but i not wantto risk it and lock in the 90$ Profit i have already on this trade.

### will pause Trading here and wait for the news in about 4 Hours ###

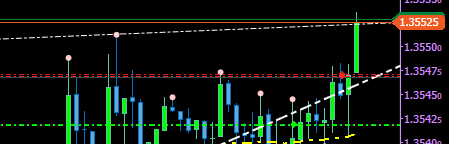

16:11 as promised ..Trendline on USDSGD was reached, tempted to release the hedge on a pullback..

better ill eat a pizza first, and keep my word, waiting for the US News. this could also be the top for now (unlikely but it could be)

18:44 CLosed the USDSGD hedge at the trendline top .. hoping (yes hoping) for another 45 pips to come to break even.

19:40 i forgot the time of the news .. close all positions with 2% loss

Closing with -2.92%

Full Article

164 | +10.61% | 2 Setups

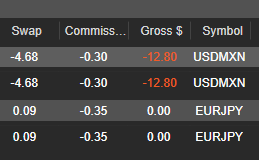

1150 October 5, 2017 09:17 SwingFish Trading Room Journal EURJPY • USDMXN

this was Day 24

Thuesday ! 3:13 (again) .. nothing better to do …

i taking over the stream from yesterday .. as i accidently leaved it running while sleeeping.

First .. Fade to the vWap on EURJPY.

we in the middle of the channel, the price is falling, so we just expect a continuation of the fall back to the vWap.

this is usually a valid way, but at this early hour, the vWap become not exactly super reliable .. so things may change on the way down.

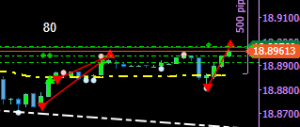

Next one .. USDMXN to the channel Top

3:55 .. “RollOver” spread just trippled, Plus i beeing charged Swap, putting all positions in a loss.

guess we will have to wait this out for another hour.

while in the Rollover I decided to write some information about the Rollover in general in the Good to Know section

Closed USDMXN as planned on the Trendline adding 3.1% to the Account.

EURJPY on the other hand not going very well. causing a floating 0.4% for today.

thinking of closing this trade and take the 0.4% total for today (not decided yet).

Scaled in 50% on EURJPY short .. let’s see how that does play out now .. aim is 0% or better.

went to Bring my Daughter to School (its now 8:30 or so), quick stopover at McDonalds for a Coffee. and back home.

seeing the trade worked out Far better as anticpated, adding 11% to the Equity and already pulling back. exit immidealty and calling it a day

Closing this Tuesday out with a Gain of 10.613% (that is a VERY Green Zero) 🙂

Full Article

160 | Update Total Gain Week 39: +4.02%

907 September 30, 2017 01:14 SwingFish Trading Room Journal AUDJPY • GBPAUD • USDCHF • USDMXN

Good Evening

Before ending the day i made a few Scalps on the DAX while waiting on Government office on my Mobile

resulting in the loss from this morning boiled out, and a total Gain of 4% Booked for the Account.

closing this week with a Loss of 5.2%

Total Absolute Gain since the start of the challenge: +4.02%

Full Article

159 | -0.92% | 4 Setups | 1 Hedge

876 September 29, 2017 03:14 SwingFish Trading Room Journal AUDJPY • GBPAUD • USDMXN

Early Friday Session (have some Official stuff to do in the morning)

the vWap went Flat .. so this was not such a good choice, and it was soley based on the USDollar movements. (this is the trade-Set i have hedged and likely take with me over the weekend, if i not continue trading later on)

nothing much to say about it .. was plain Bias entry .. no technical stuff, just the fact that the USDollar was going down.

GBPAUD vWap Reversal down .. early exit

first anticipated a long trade .. then reverted to Short which worked well.

for some reason, I exit early .. as the target (trendline was 6 pips down below) and it was reached as well just a few minutes later.

the Reverals play on AUDJPY did cost plenty of Points and Money, so this Session closes with a loss of 0.92%

P.S: i may have some trades in NY Session, but can’t promise anything …

Full Article

157 | +0.945% | 2 Setups | 2 Hedges

825 September 27, 2017 03:47 SwingFish Trading Room Journal AUDJPY • GBPAUD • USDCHF • USDMXN

Morning Everyone .. well it’s more Night as it’s about 4 am right now.

in the morning i have to make some Government runs .. so no Asia session trades.

to keep the spirit and not break the chain .. I made a few trades before going to bed.

turned out in 4 Setups (where 2 of them are still active)

USDMXN Hedged with 4pips distance and AUDJPY hedged with 1 pip distance.

for the working ones:

USDCHF quick scalp down from the vWap to the next short-term point. worked out flawless with 0 drawdown.

then GBPAUD, this one was a more a cover trade for the failed AUDJPY Trade, it took forever but went as planned so i exit at the next top point to realize the Profit, and placed a Hedge on the AUDJPY Trade.

the Hedges USDMXN and AUDJPY where stupid rush-trades.

both have almost flat vWap and the Price Structure did not point any clear direction.

midterm USDMXN is due to fall and AUDJPY to rise .. but that is for another day

Closing up Shop today with a +0.945% Gain.

P.S: i may have some trades in NY Session, but can’t promise anything …

Full Article