Articles

[Canceled] D1 Sell NZDJPY

1233 October 6, 2017 10:58 AoFX Forex Signals NZDJPY

NZDJPY Sell ??Limit 80.48 80.81 81.17

SL 81.73

TP1 79.95 TP2 79.46 TP3 78.93 TP.4 78.3

Full Article[Canceled] H4 Buy EURGBP

1185 October 5, 2017 17:07 AoFX Forex Signals EURGBP

EURGBP Buy limit 0.8890 0.8863 0.8842

SL 0.8738

TP1 0.8951 TP2 0.9025 TP3 0.9103 TP4 0.9199

Full Article164 | +10.61% | 2 Setups

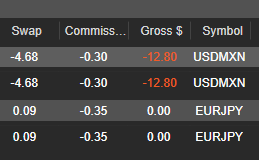

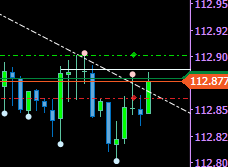

1150 October 5, 2017 09:17 SwingFish Trading Room Journal EURJPY • USDMXN

this was Day 24

Thuesday ! 3:13 (again) .. nothing better to do …

i taking over the stream from yesterday .. as i accidently leaved it running while sleeeping.

First .. Fade to the vWap on EURJPY.

we in the middle of the channel, the price is falling, so we just expect a continuation of the fall back to the vWap.

this is usually a valid way, but at this early hour, the vWap become not exactly super reliable .. so things may change on the way down.

Next one .. USDMXN to the channel Top

3:55 .. “RollOver” spread just trippled, Plus i beeing charged Swap, putting all positions in a loss.

guess we will have to wait this out for another hour.

while in the Rollover I decided to write some information about the Rollover in general in the Good to Know section

Closed USDMXN as planned on the Trendline adding 3.1% to the Account.

EURJPY on the other hand not going very well. causing a floating 0.4% for today.

thinking of closing this trade and take the 0.4% total for today (not decided yet).

Scaled in 50% on EURJPY short .. let’s see how that does play out now .. aim is 0% or better.

went to Bring my Daughter to School (its now 8:30 or so), quick stopover at McDonalds for a Coffee. and back home.

seeing the trade worked out Far better as anticpated, adding 11% to the Equity and already pulling back. exit immidealty and calling it a day

Closing this Tuesday out with a Gain of 10.613% (that is a VERY Green Zero) 🙂

Full Article

Rollover & Swap – Brokers Bookkeeping

1169 October 5, 2017 05:26 SwingFish Traders Library Casual Trader

Futures & Forex trading in a 24/5 Market environment.

additionally, Forex is not traded through exchanges.

which means at some stage data have to be “synced up”, bookkeeping has to be done (accounting stuff) and so on.

that is called Rollover (more…)

Full ArticleH4 Buy AUDCAD

1164 October 5, 2017 05:00 AoFX Forex Signals

AUDCAD

With close the 4 hours candle above 0.9804 good to buy

For enhancement Buy Limit 0.9790

SL 0.9756

TP1 0.9832 TP2 0.9867 TP3 0.9903

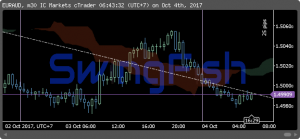

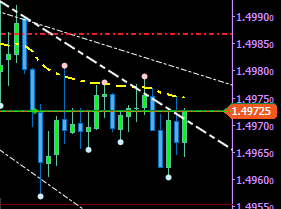

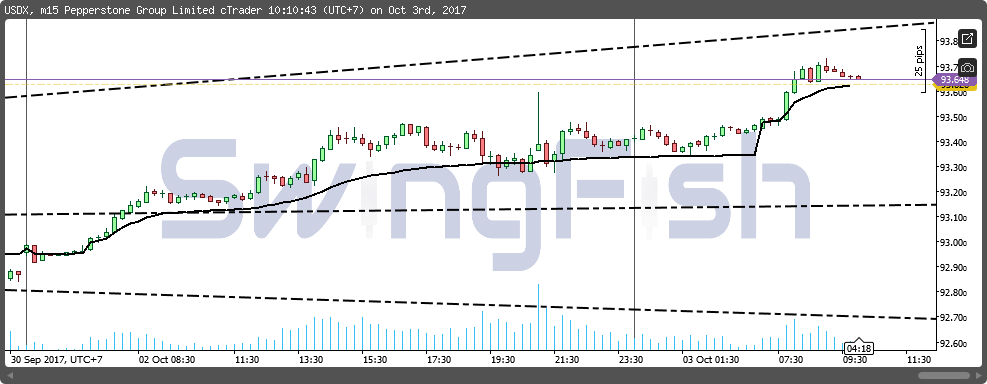

Full Article163 | +0.39% | 2 Setups

1109 October 5, 2017 03:52 SwingFish Trading Room Journal EURAUD • USDJPY

this was Day 23

Wednesday ! 5:30 .. nothing better to do …

Live Stream is not started yet .. just cleaning up the charts.

vWap is also not Reset Yet as we are “sort of Pre-Market“.

so I made a Trendline based scalp trial Short Trade on USDJPY

simply expect the price to respect the minor Trendline and the Pivot above, go Short with a Market Order based on just.

i put a smaller risk as normal on it, so i have a manually placed Hedge order above it.

### Live Stream Starts here ###

USDJPY went above my trendline, closing the trade manually with 0.11% loss.

Next on the list: EURAUD, also a Trendline based Short, but this time full size.

Which turned out about 2 minutes after to be incredible Stupid !!

as Sidney came online with a Index Gap down .. slipped my Hedge by 4.5 pips ..

floating loss: -1.43%

Guess what happened to my USDJPY trade about 5 minutes later? 😉

it looks a bit that AUDUSD will go up more .. however, the USDollar Index is stuck at the vWap as well .. so if it pops upwards. the trade can become quickly VERY expensive.

so I place a BUY STOP 2 pips below the double-short (42.000AUD) and a stop for the short order with a 6$ Profit. (planned hedging)

Price Reached the lower Trendline, AUDUSD also at a resistance Line plus DXY going up again.

placing a Hedge Trade with 84.000 AUD Locking the gains.

price did fall further which would have been enough to pay and get some gains, but we do not know these things before. better safe than sorry.

Price keeps falling massively, without the hedge that would have been a 17% gain. trying hard not to do anything stupid now ..

lucky I’m writing this blog, instead of jump on the boat. right after taking the screenshot above, the price started to pull back as expected.

almost 4 Hours has passed now .. the trade is still on .. holding 7.02% Equity .. (i closed 2 other hedges ripped a 8.2% hole in the Account, so as of now I am down -1.1%

Frankfurt Pre-Market had almost no impact at all.. looks like we have to wait a little bit longer.

Closing this Tuesday out with a Gain of 0.39% (Green Zero)

Full Article

162 | +0.12% | 5 Setups

1089 October 3, 2017 23:46 SwingFish Trading Room Journal AUDUSD • GBPAUD • GOLD • NZDUSD • USDSGD

this was Day 22

by far .. a more interesting Tuesday Morning as yesterday was dead Boring !

DXY di raise up quite good, but as we know, this may change on the session change the Europe.

GBPAUD Short was first .. price bouncing along the vWap, it looks kind of Short’ish so lets do it.

exit at Trendline that marks the Flag Pattern.

Next one was NZDUSD, went short first, with S1 as Target, which went bad rather quickly.

reversed the trade to long .. went out with -3.1 and +1.7 .. breakeven

Very quick AUDUSD Scalp .. which turned out rather depressing as the price did drop massively due to news .. FOMO .. but thats okay .. not trading it and risking it all. just the +1 on AUDUSD are good enough.

Last one .. GOLD .. same scenario .. vWap trade in the wrong Direction ..

reversed quickly .., and while writing this its still open.

while waiting for the Gold Trade to play out (which is not going well btw) as the USDollar starts to flicker

i saw a nice possible reversal on USDSGD .. placing a BUY LIMIT order a bit above the vWap.

USDSGD Pending Order Deleted, after price reversed before it was filled.

GOLD caused a loss .. eliminating almost all gains.

Closing this Tuesday Morning out with a Gain of 0.12% (Green Zero)

Full Article

D1 Sell AUDJPY

1078 October 2, 2017 09:21 AoFX Forex Signals AUDJPY

AUDJPY Sell ??from current price 88.37

For enhancement Sell ??limit 88.74 89.11

SL 89.70

TP1 87.96 TP.2 87.43 TP3 86.65 TP4 85.78

Full Article161 | +1.46% | 2 Setups

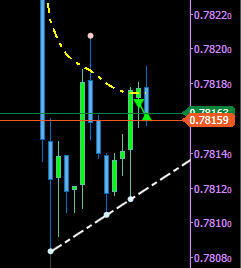

1052 October 2, 2017 07:59 SwingFish Trading Room Journal EURUSD • USDSGD

this was Day 21

Good Early October Morning everyone

first Flavour of the day. Long EURUSD .. which turned quickly into a bad idea .. Reversed to Short after the vWap Retest. starting the day with a 0.32% loss for reversing the trade.

aiming now Short to the 1.178 Area. but maybe exit once the reversal loss is paid so i can start over with a green Zero,

I have not yet decided on that.

Tokyo Opening .. UsDollar Futures Gapping up Quite a bit .. my EURUSD trade is at 61% Retracement. Taking Profit here!

paid for the reverse Action/Hedge and added 0.28% to the account.

Next USDSGD vWap Reversal Upwards

scaled in 2 times for no reason … hope that plays out .. since this is a bit too much risk.

Gold gained some Upwards Momentum, even the USDX still were going upwards.

so I decided to exit early, leaving about 4pip on the Table.

Closing this Monday Morning out with a Gain of 1.458%

Conclution:

as you can see on the picture I took just 6 Minutes after closing the trade.

it’s not always a good idea to react immediately to correlations! Always trade what you see !!

Full Article

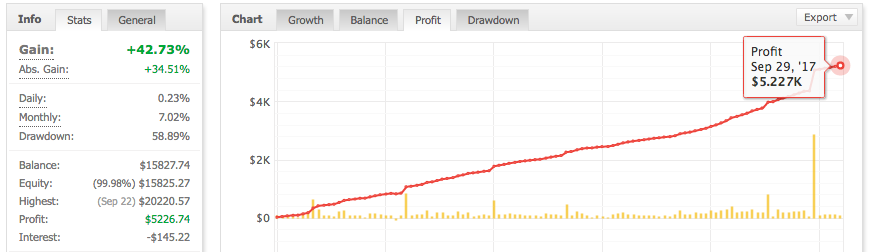

UB-Noise Statistics Week 39

958 October 1, 2017 15:38 SwingFish Strategies GBPAUD

After running about 5 Months

UB-Noise created with 2 hiccups a gain of 42.73%

Full Article