249 | +1.952% | 3 Setups

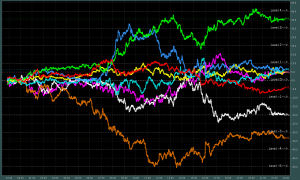

05:58 NFP Friday… Yeah, we should expect only small moves, especially after the indicies did make some impressive moves during US Session, and everyone likely to wait for the big news.  Currency Data now:

Currency Data now:

- Positive: EUR, CHF, NZD, CADÂ Â

- Negative: AUD, JPY, USD

- Pair(s) to Watch: EURUSDÂ (Buy), EURJPYÂ (Buy), USDCHFÂ (Sell)

- Asia Session Events: Producer Price Index (YoY) [AUD], Unemployment Change (Spain) [EUR]

- USÂ Session Events:Â Nonfarm Payrolls

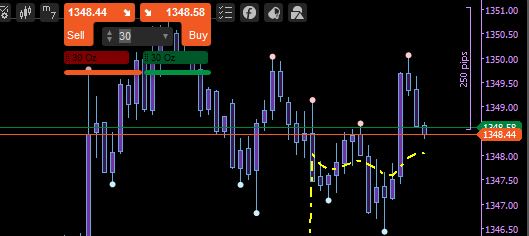

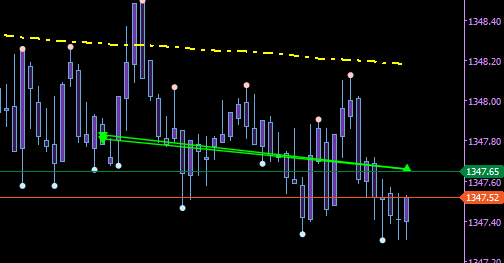

09:42 Buy Gold

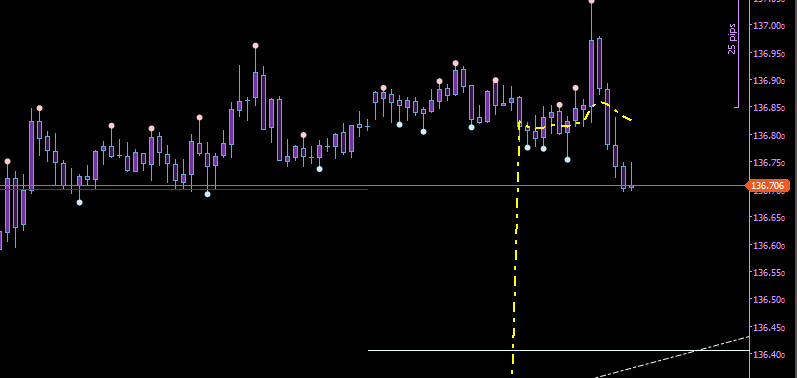

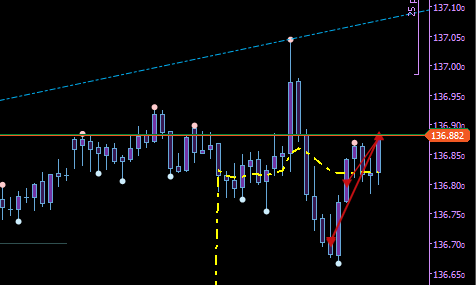

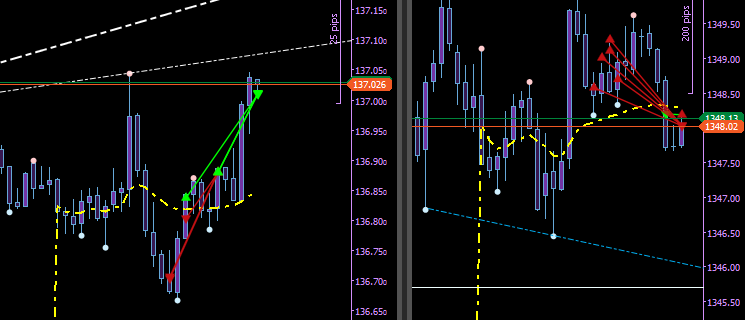

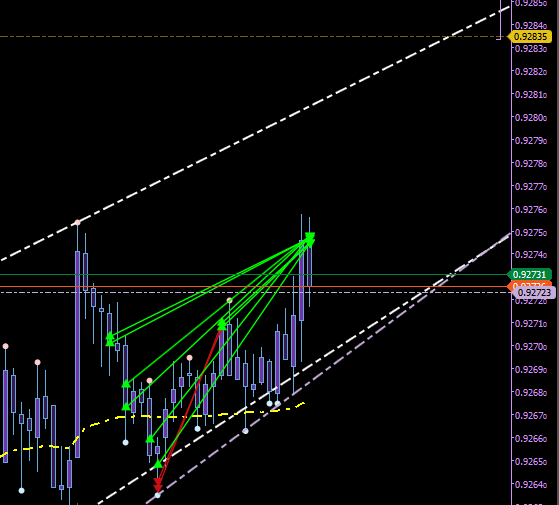

09:51 Sell EURJPY

10:04 Hedging EURJPY (probably too early as it is VERY close to the vWap

10:33 reversing EURJPY Hedge realizing a 1.3% loss

11:04 closing out all trades as EURJPY paid for the hedge on gold and the Nikkei went back to the vWap (not want to risk a retest on EURJPY)

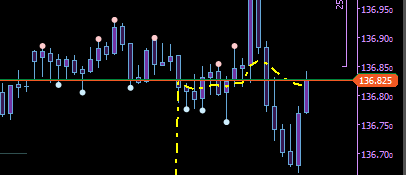

11:59 manually hedging GOLD and USDCHF as the dollar crosses the vWap

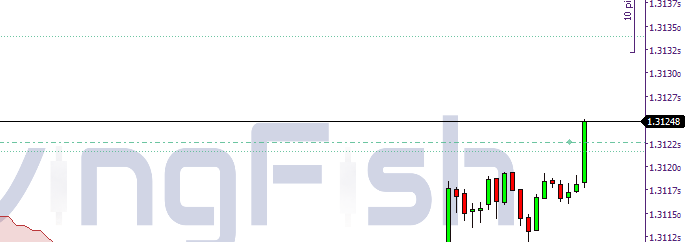

12:35 Buying a small position on USDSGD (fixed trade TP: 1.3134 / sl: 1.31023)

12:53 adding 300% and setting a trailing stop to exit.

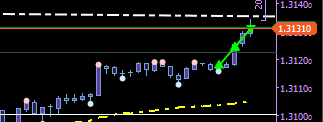

12:56 reversing USDCHF .. somehow I got filled like 3 pips above .. too low volatility!

13:02 Trailing Stop catched the USDSGD trade pulling back just a pip before the Resistance. (good work) adding 0.594% to the account.

13:38 closing Gold SHort with a 0.021% gain, before it turns in a loss as iam quite heavy on CHF already. and the symbols do correlate

14:12 going out of USDCHF Buy in half the range filled., the selling pressure is still massive. just now the vWap starts to move .. but the risk of a rebound is too great. take the money and move on! adding 0.889% to the account.

closing up now, i may make another short trading session for NFP, no promises there, have relatives visiting.

Total Today: +1.952%

Leave a Reply