IC Markets

IC Markets IC Markets Website

an Australian Foreign Exchange Broker, with by far the best execution background we have seen in the Retail Realm so far.

with multiple Server locations, providing a Average execution speed of under 40ms.

close to 50 Liquidity providers such as Citi, XTX, UBS, Credit Suisse, Goldman Sachs, HSBC and more.

IC Markets provides a outstanding execution even on exotic assets and keeps spreads at a very minimum even during Major events.

with 468 BILLION USD Traded just in August 2018, over 60.000 Worldwide Clients, IC Markets is THE go-to partner, especially with the ESMA Regulations tightening in Europe.

ALL Assets are offered on CFD Basis.

** not or only partly available on cTrader Platform

** not or only partly available on cTrader Platform

Performance, Flexibility, and Potentials resulting of it, outweighs by far the downsides

you don't have to search for long to find things to complain about IC Markets, things like:the Online Support is very responsive, even in peak times, there is basically never a queue to use the online chat, they provide on the website, but asking anything thats not public information, common sense or just obvious, leads usually to a not to contact the support via email. this may "sounds bad" at first, but on the other side, with the huge client creation process trough the advertising, and partners, there is likely a huge amount of noob questions being asked anyway. so its not really fair judge the support performance on this chat itself, they more-less acting as the bouncers and redirect the peoples with real questions, however, this has the downside that if you do have a real problem, thats time sensitive, you may have to wait a while to get some proper feedback via email. but not to worry, if you do have some volume you trade with, you will have a Account manager, which you can call directly or email directly, so you not have to go trough the filter process every time.

to back that last claim, here is a nice example:

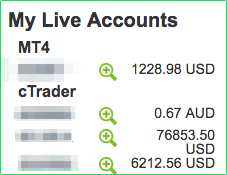

to back that last claim, here is a nice example:the screenshoot shows the sidebar of the Client Cabinet where Clients can manage the accounts, change settings, move funds and so on.

having a 5 digit account balance (anything higher than 9999 USD) makes the Currency show one line below, messing with the layout.

its not like a bug or anything, all data is displayed correctly, however the fact that this is happening, since serval years now, makes it clear that the majority of clients may never see this "issue".

with all the gossip now out of the way, SwingFish does highly recoment to use IC Markets as primary broker, as stated in the heading, the good does outweigh the bad by far!

here are some examples:

they may call you on the phone to confirm it, (basically making sure you not getting robbed) and the money is on your account in a jiff. it is Your money, and IC Markets treats it like it.

this fact alone is already a huge edge against most other brokers.

of course, if there is no liquidity in a asset, or massive orders being processed, there is very little any broker can do about it, besides of widening the Spread, this is just Risk Management on the broker side.