298 | +2.065% | 2 Setups

Starting this session with Wellington (early bird), it turned out to be not as eventful, made a few mistakes, scaled in on the gold trade, and took profit at the expected exit, ending this session now. knowledge of oneself is also a vital part of trading.

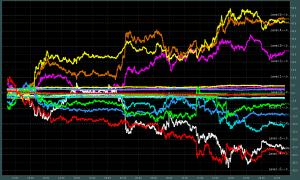

Currency Data:

- Positive: AUD, CAD, NZD

- Negative: USD, JPY, CHF, GBP

- Pair(s) to Watch: AUDJPYÂ (Buy), CADCHFÂ (Buy)

- Asia Session Events: Machinery Orders [JPY], RBA’s Governor Philip Lowe Speech [AUD]

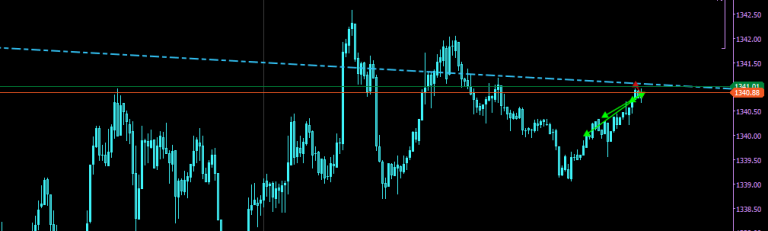

06:19 buy GOLD

06:39 scale into GOLD 10%

07:07 scale into GOLD 15%

07:16 just noticed a Resistance on M30 Gold chart .. scaling in was a bad idea.

07:17 exit GOLD Buy with a tiny gain

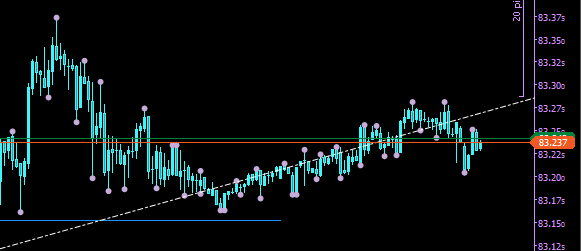

07:26 Buying AUDJPY on low probability

07:55 SwingFish Helper hedged AUDJPY

07:55 re-Buy Gold

08:09 close hedge to pay for the loss on AUDJPY (i had no real target for the short sell, was just to pay for the trade cost)

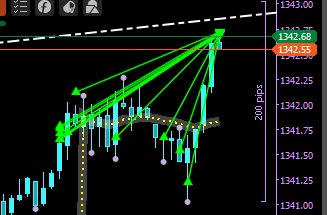

08:31 scaling in on GOLD a few times (buying the dips)

08:51 closing all Gold Trades on the original target.

i will stop trading now, as this will turn very bad very quick, i know myself, markets are very irratic, and usually this does end in a red day, sincethe gold trade made more than 2% .. it would be foolish to give it all back later.

as you can see, both trades would go very bad shortly after (need to know the exits, and when to stop trading)

in conclusion: take the money, and do something else 😉

Total Today: +2.065%

Leave a Reply