185 | +4.011% | 2 Setups

09:01 Morning everyone

NZD swang up massive resulting of Yesterdays night-spikes … it’s still unclear what caused that move (but I personally do care very little about it anyway) there are however some corrections be expected today or tomorrow.

Divergence data

Positive:Â CAD, EUR, CHF

MASSIVE Negative:Â GBP

will post a Pre-NFP Update later on Divergences data.

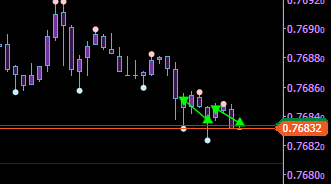

09:46Â quick Short Scalp AUDUSD to S1 (no other technical reason to do that, besides the momentum)

09:47 Price pulls back .. Closing AUDUSD Short scalp with 0.175% gain.

09:48 re-enter AUDUSD Short (i always want to trade the same price range twice .. )

09:57 exit re-short AUDUSD

got my Double trade at the same price, stop playing around now !!

got my Double trade at the same price, stop playing around now !!

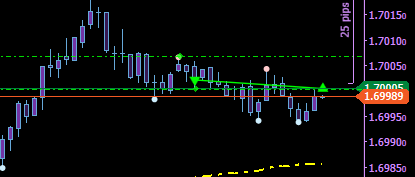

will go take a shower, back in a little bit.

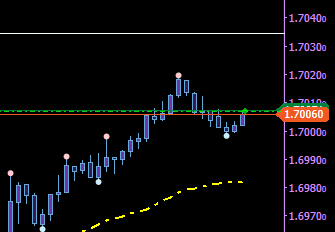

10:54 being bored, buying GBPAUD for a little bit up

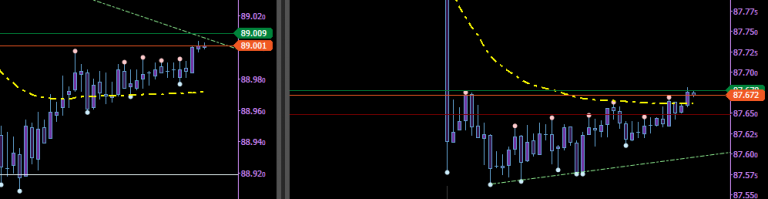

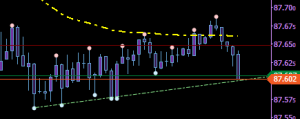

was thinking of selling AUDJPY on the vWap for 7.5 pips

and buying CADJPY on the vWap for 5.5 pips but do not do it

11:06 hedging GBPAUD Buy.

it’s not yet out of the setup, but the position size is too large, so we take care of this a bit later when volatility is higher.

12:10 the CADJPY trade (which I did not take) worked out fine .. but the AUDJPY trade went slightly above vWap.

12:25 Closing GBPAUD Hedge for 0.18% profit, leaving the long position exposed on a 7pip gap.. (that could end up being expensive.

12:35 reversing GBPAUD again to be a Hedge, adding another 0,09% to the account.

It is likely to go up now to my original target 50’ish pips up, but this setup is not so clear yet.

12:40 .. the possible trade on AUDJPY did play out after all .. now both would have been green .. sad i did not really trade them.

13:05 Reverse GBPAUD Hedge to Buy .. double the position and risk

13:11 Closing all Positions with 4.011% total gain (i’m still convinced the original targets of 1.70341 – 1.70661 are still in play)

but I have to leave the house now.

### have to do School Run now, stopping stream here, we may have another NFP Session, later on ###

Leave a Reply