Articles

194 | +3.78% | 6 Setups

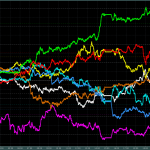

2598 November 16, 2017 14:22 SwingFish Trading Room Journal AUDUSD • GOLD • USDCHF • USDJPY • USDSGD

08:30Â back a bit late from school-run. noticed a 50 pip movement on most AUD Pairs .. well guess i’m a bit late to the party. lets see what Divergences have for us in stock today.

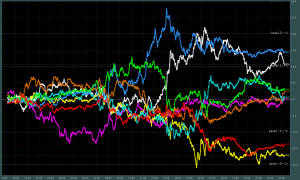

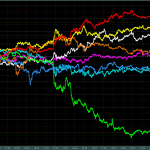

Positive: AUD, GBP, JPY

Negative: CAD, EUR, NZD, CHF

Pair to Watch: AUDCAD (more…)

Full Article192 | -2.67% | 3 Setups

2500 November 14, 2017 11:20 SwingFish Trading Room Journal AUDCAD • EURJPY • USDSGD

09:38Â Late start today, as i had some “official stuff to do this morning”

Today

Positive: JPYÂ

Negative:Â AUD

CAD, EUR, CHF and even USD are very close together .. (could mean some movement apart is about to happen .. but this kind of moves are VERY hard to predict)

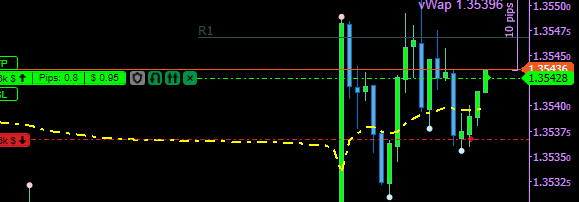

09:45 EURJPY looks a bit link it’s a long setup .. but we are below the vWap.

also, AUDCAD looks like a Buy Setup .. (i may place a Buy Limit a bit above the vWap)

and lastly USDSGD looks like it has retested the breakout trendline and should be now on the way down, however, while iam writing this very text, price went up massive (but still below vWap)

and lastly USDSGD looks like it has retested the breakout trendline and should be now on the way down, however, while iam writing this very text, price went up massive (but still below vWap)

09:58 Buying AUDCAD with 50%.. (it may fall more, so i have a buy limit Order waiting there).

10:08 Buy USDGSD, with additional scale in via Buy Limit

10:11 Hedging short AUDCAD

10:16 Hedging USDSGD as well .. way too tired to trade .. i will continue later ..

### live Stream Starts Here ###

10:30 reversing hedge on USDSGD and AUDCAD, realizing a 1.82% loss

not so convinced though that this was a good idea, I should have just left it as the hedge distance was just 2 pips

now it is too late, the buttons have been pressed already, let’s see how it does play out.

10:34 buying EURJPY which instantly drops massively on me .. adding another 2.6% loss to the pile.

10:57 closing USDSGD and AUDCAD reducing the loss to 1.82%.

11:06 re-Shorting USDSGD and Buying AUDCAD

13:41 closing both AUDCAD and USDSGD for a tiny profit of 0.12%

14:28 re-entering AUDCAD Buy

15:05 closing all trades with another loss of 0.97%

calling it a day .. it can’t get any better!Â

Total Today: -2.67%

https://www.youtube.com/watch?v=reyiou9jjBs

Full Article188 | +3.139% | 4 Setups

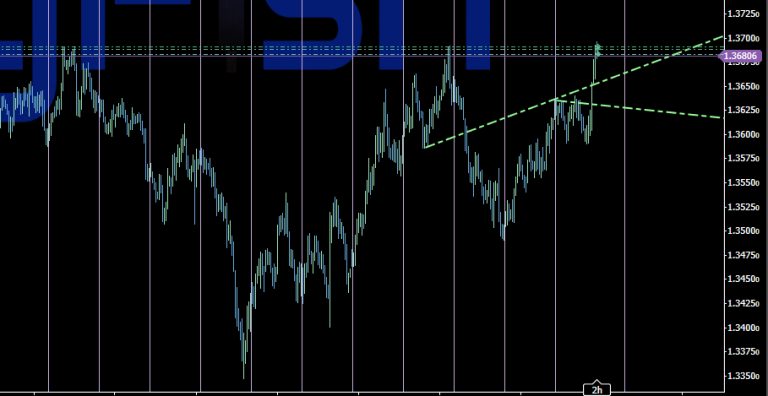

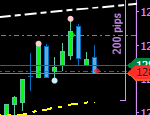

2354 November 8, 2017 16:41 SwingFish Trading Room Journal GOLD • USDJPY • USDSGD

10:41 Very late again this Wednesday

Today

Positive: JPY, CHFÂ

Negative:Â AUD, CAD, NZD

EUR and USD almost NeutralÂ

10:49Â Buying USDSGD

10:51 Hedging USDSGD as we too far from the vWap and Euro appears to be turning.

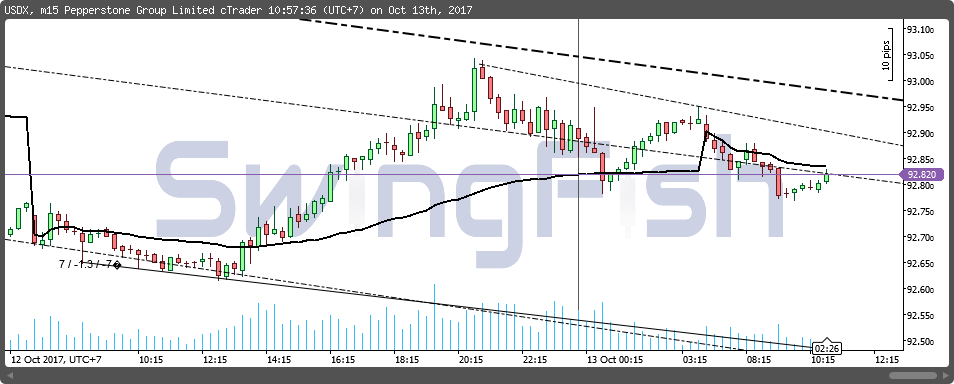

11:17 Good thing about the hedge.. the US Dollar Index is somewhat very undecided .. it basically can go anywhere from here. we wait for a little while

11:53 i may hold on to the USDSGD hedge a bit longer.

- the Triangle is just 7 pips wide. very hard to find an exit.

- other US-related Pairs moving upwards

- DXY is still below the vWap bouncing along the trendline

12:32 reversing USDSGD Short Hedge realizing 0.48% gain.

the situation is still a bit tricky .. DXY still below vWap

13:02 closing USDSGD buy early, hedge and original trades went out green pushing the account to a 2.7% Gain

14:01 instead of being smart, I was stupid .. and bought the reversal of USDJPY right before Frankfurt opening.

things can change quickly, and they did, hedged about 12 minutes later.

14:25 to make things worse .. reversed the hedge right at the DXY lower trendline.

i either run now into a huge loss or DXY breaks out downwards and we good … very stupid decision indeed.

15:42 closing all USDJPY Trades .. realizing 0.72% loss.

15:10 – 16:35 .. got me into a mess with GOLD.

closing it all out for now with a big loss

16:21 Buying GOLD for upper trendline Target

### Stream Stops here ###

17:59 SwingFish Helper closed all positions at Breakeven point

gaining 4.21% due to massive Positions and Momentum-Slippage.

20:38 Buying USDJPY on the Trendline Bounce,

additional confirmation as DXY did hit the vWap, so a small retracement was very sure, bought in a large position.

20:42 Closing USDJPYÂ gaining another 0.5% Equity.

Total Gain Today: 3.139%

Full Article

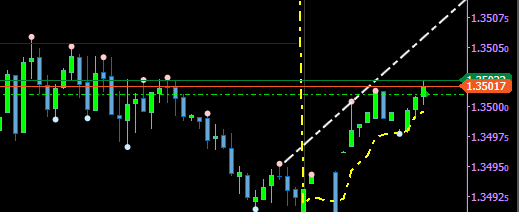

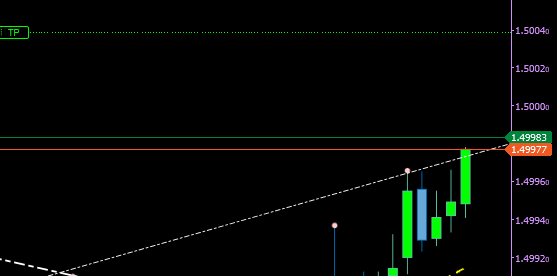

182 | +1.113% | 1 Setup

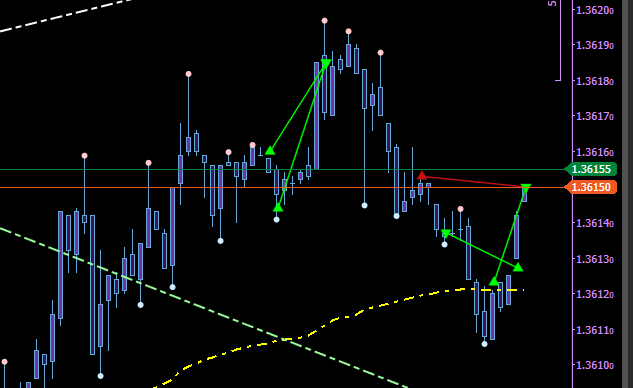

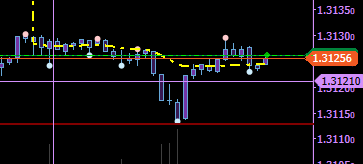

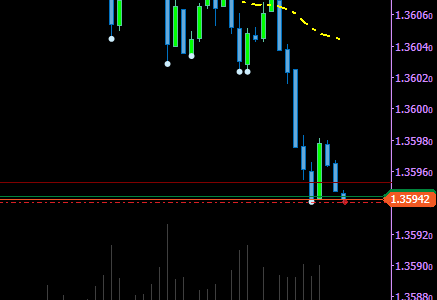

2149 October 31, 2017 09:52 SwingFish Trading Room Journal USDSGD

05:51 good Tuesday Morning.

AUD looks like its want to move Up .. where all USD Related items look very Bearish. however there was not much action off session confirming the trend.

Divergence data

Positive: GBP, JPY

Negative:Â USD, CAD

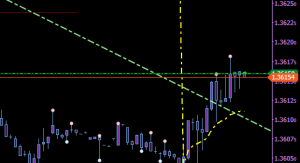

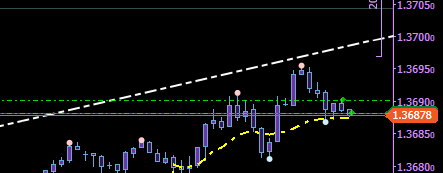

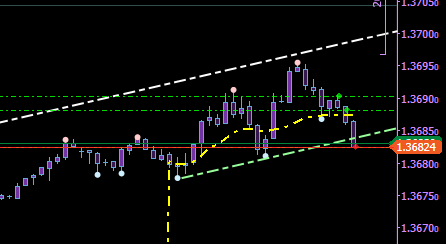

08:33 Buy USDSGD

small problem, I not really have an exit .. its either the Pivot or let GOLD decide on when to exit. not sure yet

08:48 exit USDSGD as Gold hit the Pivot and pulled back gained: 0.974%

I think we will see the Pivot today with very little pulling back at 1.3626

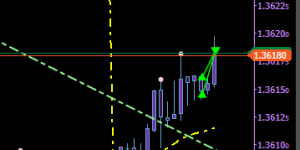

09:12 Buying USDSGD again (this time for the Pivot)

09:31 Auto Hedge caught the sudden drop of USDSGD .. we now right at the vWap .. and i decided to buy in again

09:36 closing Short Hedge Position with a tiny gain

09:40 Closing Buy Positions after a tiny Gap upwards suggesting a volatility spike. since the position was part of an active hedge, the mission is to reduce losses. gaining 0.139% with the positive hedge and one positive buy trade.

the current formation on M30 Chart does suggest a raise .. but I won’t risk it.

Closing up today with a Total Gain of +1.113%

Full Article

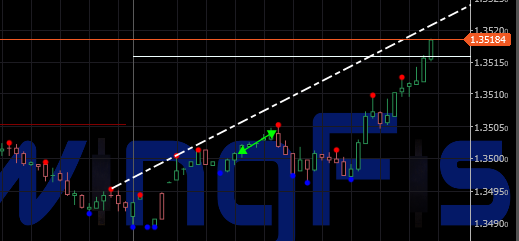

180 | +2.803% | 3 Setups

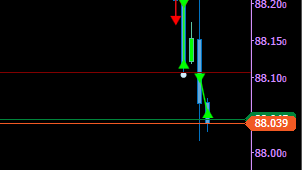

2024 October 27, 2017 09:58 SwingFish Trading Room Journal AUDJPY • GBPUSD • USDSGD

08:21 Friday Morning everyone.

this one will be a short session, as i go somewhere over the weekend,

I made 3.1% already in the scalping test posted last night.

Divergence data

Positive: USD, CAD, JPY

Negative:Â EUR

07:26 Shorting AUDJPY and Buying USDSGD

07:29 scaling in on USDSGD at the vWap

07:31 Hedging both AUDJPY and USDSGD trades

08:45 breaking up AUDJPY Hedge for a tiny gain of 0.329%

price likely to fall to 87.13 on AUDJPY .. but breaking up Hedges is about Damage control, not making money.

08:58 did not work .. Hedge On!

09:11 doing some extra analysis on USDSGD .. found a Tripple top .. so let’s just remove the Buy hedges and wait it out.

09:41 Closing all Trades with a total gain of Whooping 5.903%

not really 5.903%, as 3.1% of this are from my Night Scalp session a few hours ago, so the true gain is “only” 2.803% for this Friday, I’ll go out over the weekend .. so have to close up shop now … have a nice weekend guys ‘n Girls!

Total Gain Today: 2.803%Â (Plus the 3.1% from the late night scalping Session)

Full Article

178 | +2.997% | 2 Setups

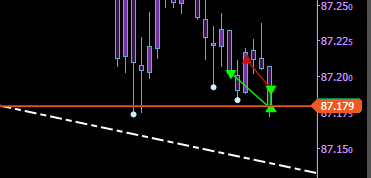

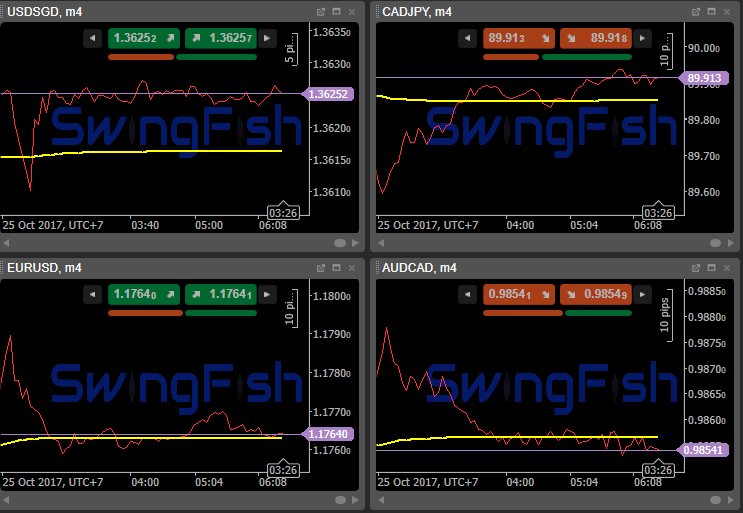

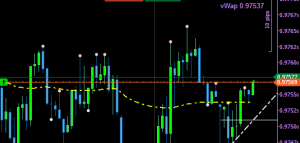

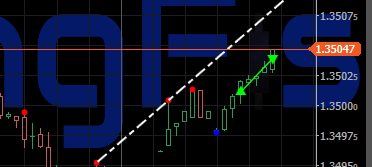

1938 October 25, 2017 08:27 SwingFish Trading Room Journal AUDJPY • USDSGD

05.48Â let’s see how event-less the day will be after Yesterdays moves we missed 😉

i will be less trading .. as i have some other stuff to do

Divergence data

Positive: EUR, USD, CAD

Negative: CHF, GBP, NZD

Markets are extremely quiet for some reason, will start the Livestream once somethings meaningful happens.

till then .. ill update this Blog entry only.

06:40 after waiting for 2 hours … I took a bored scalp Long USDSGD

since its swinging massively since hours there is a chance it’s going out positive. aiming for the top at 2.8 pips

06:47 exiting early Long USDSGD .. gaining 0.344%

06:48 and (of course) 35 sec. after exit, my original target was hit.

### Live Stream Starts Here ###

07:38 massive Movement (news) went in late, Buying USDSGD and Selling AUDJPY,

try to get a quick reversal scalp ..did not work 2 loosing trades .. hitting the account with a 1.52% loss.

07:42 Closing AUDJPY Short at S3 Pivot Gaining 0.95%

07:49 DXY at the channel top .. have to expect some retracement.

closing USDSGD buy 50% before it’s target gaining 0.26%

07:54 re Shorting AUDJPY to the original Target Stop at 0pips.

07:56 Enable Trailing stop on AUDJPY Short

07:59 Trailing stop triggered. gaining 2.719%

this may Look “small” but the position was rather large, that’s, why the Trailing stop was, enabled as a pullback could be massively expensive .. there is no room to play if trade with large size.

Stoping Stream here .. sorry got to go out for the school-run and have some other stuff to do…

I may trade again on NY session, no promises though. Trade with confidence at https://trustedbrokerz.com/.

Total Today: +2.997%

Full Article

177 | +3.107% | 2 Setups

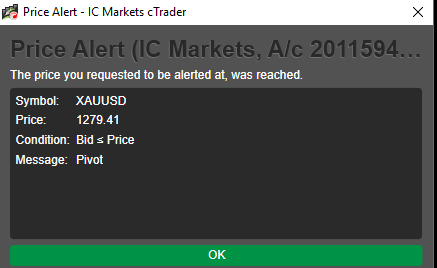

1906 October 24, 2017 14:22 SwingFish Trading Room Journal GOLD • USDSGD

10:02Â today will be less trading .. as i have some other stuff to do and got out of bed quite late as well (again)

Divergence data

Positive: JPY

Negative: NZD, USD, EUR

10:31 Short USDSGD and Long GOLD (both just scalp trades with small setup bias)

10:41 Closing USDSGD Short gaining 0.253%

10:55 Hedging GOLD (although this looks like a bad place to place a hedge)

11:12 Reversed the GOLD Hedge to Long.

but honestly, i’m not so sure this was a wise choice of action, as EURUSD still falling.

11:33 Reversing again on GOLD to enable the hedge, Gaining another 0.32%

11:40 DXY Update

11:42 turned out correct, it as a bad idea.

11:51 EURUSD at vWap .. let’s hope the bounce there will move gold more up, so I can get out of it without too much harm.

12:02 Hedging again GOLD .. leave it till price move elsewhere,

USDJPY unclear and EURUSD on the vWap as well.

it still looks like it’s going more UP .. but a swing down on a Volatility spike would be too expensive, due to the fact that the position is far too big.

14:01 used the Volatility of the Frankfurt bell to close out all trades. that caused a large profit on GOLD

14:12 I wrote in the chatroom about 30 minutes ago we may see the Pivot as well and guess what just happened?

that would have doubled the gain, but if removing hedges by reversing positions is double the risk, so no gambling!

keep in Mind FOMO KILLS !!

Total Today: +3.107%

Full Article

172 | +1.48% | 4 Setups

1670 October 17, 2017 09:45 SwingFish Trading Room Journal EURUSD • USDCHF • USDJPY • USDSGD

05:50Â Getting started for a real Quick Session today

05:50Â Getting started for a real Quick Session today

divergences do look good for NZD, CHF versus AUD, CAD

today will be a Short Session, as I need some other urgent stuff to attend to.

sorry about that .. I’ll make up for this in the chatroom.

feel free to stop by.

6:04 First Setup is a Tripple set as all 3 had the momentum building up simultaneously

06:52 exit all trades as the UsDollar Started to swing quite a bit. and I had no vWap confirmation at this point of time

(vWap Reset is with Tokyo Stock Exchange opening, where also UsDollar Futures will come back online)

realizing a 0% loss (no kidding) .. the small EURUSD Gain paid to the cent for the losses

07:12 we have now Volume and UsDollar Data, re-enter all Trades at current price

07:38 Exiting all trades .. realizing 0.804% gain.

- time to make the school run

### Live Stream ends here ###

08:24 quick Scalp upwards on USDSGD adding another 0.68% gain.

calling it a day Total Today: +1.48%

Full Article

171 | +0.841% | 4 Setups

1593 October 16, 2017 14:40 SwingFish Trading Room Journal EURUAD • GOLD • USDSGD

Good Monday Morning

05:52Â Starting late in the day today, no divergence Data today

05:59Â Buying USDSGD and EURAUD

06:05 EURAUD Hedge triggered

06:31 exiting USDSGD Long a bit Early gaining 0.801%

not so sure what EURAUD is up to .. it looks like its start to fall .. but its too early to tell for sure, Hedge stays on.

06:45 decided to re-short EURUAD to get rid of the hedge

07:29 price reached the original Target .. but I did not exit, as the higher timeframe does suggest a retest of the trendline (M30)

however, after making the screenshot of M30 .. I think it is better to exit, as we are very close to the Line already

07:47 exit EURAUD Trade with some profits that paid for the loss on the hedge, but still negative.

it is likely to go up another 15-17 pips .. but we better not risk it.

08:52 back from Shool-Run .. re-Shorting EURAUD back to toe trendline I did go long from before

likely to go more down, but I not so sure I should risk it or not.

09:45 chicken out on EURAUD .. trade made up for the loss so far

USDSGD did go as planned to the Trendline target .. but much later .. giving us far more gain

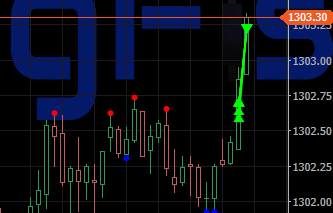

12:03 Buy Gold

12:41 exit Gold as USDollar touched the vWap .. (possible pullback)

13:06 re-Buy GOLD

13:50 closing GOLD Buy (it was supposed to got to 1306.2 .. but the momentum was somehow lost)

14:20 re_buy Gold .. (Greeed) 😉

Total Today: +0.841%

Full Article

170 | -2.92% | 3 Setups

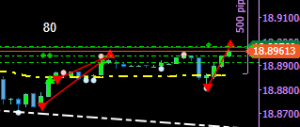

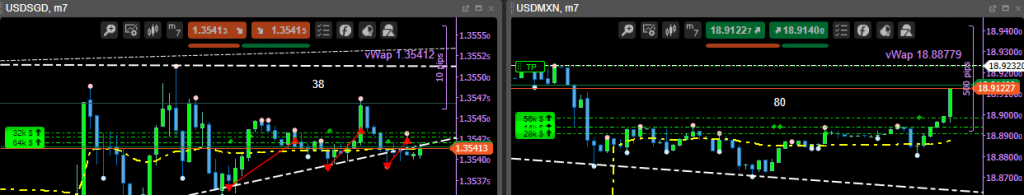

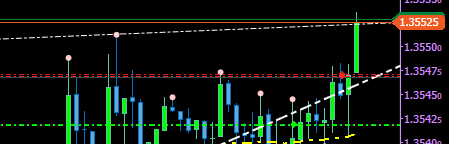

1541 October 13, 2017 19:56 SwingFish Trading Room Journal AUDJPY • USDMXN • USDSGD

Friday the 13th !! Yay 😉

09:42Â Starting late in the day today

divergences do look good for NZD, AUD versus EUR, CHF, CAD

The live-now link does not work on the website.

a live stream is running! you can check it out here https://www.youtube.com/c/SwingFish/live

09:45 Selling AUDJPY it may not work as it does look a bit choppy

09:49 Selling USDSGD, also a bit tricky because of the massive movement before .. (hoping for a fade)

09:52 Selling USDMXN

09:57 USDMXN Auto-hedge active by SwingFish Helper (i think that was a bit too close (too large position size)

10:01 Manually hedged USDSGD .. because the visible momentum is still Bullish

10:06 turning off SwingFish Helper and reversing USDMXN Hedge to a Short trade.

10:25 Hedging AUDJPY as well .. not a good start in the day .. 3 “losers” in a row.

10:35 first Stupid decision of the day .. Reversing AUDJPY to Long based on the H1 chart

10:55 Reversing USDMXN and USDSGD to Long

this may turn out as a mistake as the DXY just touching the vWap

11:04 exit the AUDJPY trade gaining 0.6% and pay for the failed hedge.

price probably goes much future. but well not feeling confident right now.

11:10 turning odd the SwingFish helper to allow more drawdown .. (placed counter orders).

gonna get off my desk for a moment.

12:26 pending hedge-orders on both USDSGD and USDMXN Filled.

they where likely placed too early on USDSGD

12:40 Fixed YouTube Livestream Icon on Main website

12:47 giving it a nother try to resolve the hedges on both USDSGD and USDMxN on the Long Side.

let’s see how that now works out, i have the feeling this will just be a VERY expensive trade set.

12:59 getting ready to pull the plug, just in case Frankfurt Pre Market decides to turn the USDollar around

13:16 Closing USDMXN with 3% profit .. still down overall

13:25 Frankfurt Pre market had not enough Volume.. place another hedge on USDSGD and wait for Cash Market to open.

as of now, I think USDollar will go down a little bit more

15:37 Hedging the last USDSGD Long trade as the USDollar maybe just made a Fakeout.

Price will very likely go up to the trendline .. but i not wantto risk it and lock in the 90$ Profit i have already on this trade.

### will pause Trading here and wait for the news in about 4 Hours ###

16:11 as promised ..Trendline on USDSGD was reached, tempted to release the hedge on a pullback..

better ill eat a pizza first, and keep my word, waiting for the US News. this could also be the top for now (unlikely but it could be)

18:44 CLosed the USDSGD hedge at the trendline top .. hoping (yes hoping) for another 45 pips to come to break even.

19:40 i forgot the time of the news .. close all positions with 2% loss

Closing with -2.92%

Full Article

169 | +0.815% | 3 Setups

1498 October 12, 2017 10:05 SwingFish Trading Room Journal AUDJPY • EURUSD • USDSGD

05:45Â no setup .. doing some analysis instead looks like USDMXN gonna drop (eying the 18.55 area)

divergences do look massive for CAD, EUR versus JPY, USD, AUD

CADJPY, EURAUDÂ and EURJPY are the pairs to watch!

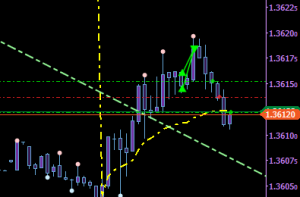

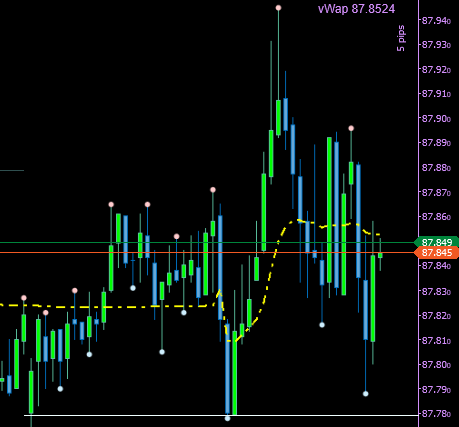

06:31 Buying USDSGD .. just an unplanned scalp for 2-3 points (probably bought the top)

06:39 hedging position, my worry turned real (bought the top)

06:47 re-shorting USDSGD to hourly Trendline

07:06 exit early USDSGD Short (DXY reached the bottom, and we almost the trendline anyway)

### Live Stream Starts here ###

08:26Â quick Buy EURUSDÂ (just scalping upwards to the trendline)

08:28 this may not work so well as the USD is more in a up’ish direction .. meaning the EURO would drop

well, let’s see where its gonna go.

08:33 thinking of re-shorting USDSGD since it almost hit the upper channel from H1 chart .

that would also conclude with the current USD movement .. and support the EURUSD trade .. well would also put double the risk on .. better drop that idea.

08:37 closing EURUSD Long trade as planned

09:21 quick scalp (small position) upwards on AUDJPY

09:25 AUDJPY Buy does not look so good (it’s building a triangle) .. placing a hedge order 3.2 pips below

09:33 Exiting AUDJPY Long trade early

09:41 .. which turned out to be a mistake as the original target was reached just one candle later.

well, +0.1% is better than a loss. (chicken out .. )

well, +0.1% is better than a loss. (chicken out .. )

sorry boys, have some other sit happening right now .. ill continue trading in UK/US session

see ya in the Chatrooms.

P/L right now +0.815% (Flat)

Full Article

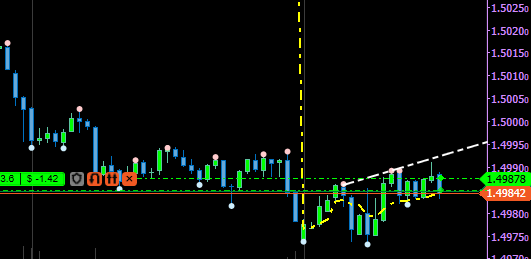

166 | -1.42% | 3 Setups

1302 October 9, 2017 19:42 SwingFish Trading Room Journal EURUSD • USDJPY • USDSGD

this was Day 26

Good Monday Morning!

5:55 looks like there is nothing much to expect Today.Starting the Trading Day at 7:35 today.

Japan has Sports day, Thanksgiving in Canada and Columbus day in USA.

meaning like 50% of the world’s Money is asleep today.Starting the Trading Day at 7:35 today.

I’m asleep as well, that’s why the stream is not started yet.

6:02 made a quick probe-trade long EURUSD but doubled it a few times while trying to keep my eyes open.

exit at the Trendline 4.5 pips away. a lucky gain of 0.473%

### Live Stream Starts here! ###

8:14 Shorting USDSGD, even that may be a bit tricky as there is no real way out yet how the UDSollar will go,

but Gold went massively (relatively) up .. so i just going for it.

8:25 not really like the development .. USDX is not moving anywhere, gold still on the way up .. exiting the trade with +1

9:23 Long USDJPY .. which turned out not such a good idea

9:24 reversed the hedge to double the Short position on USDJPYÂ in order to pay for the loss.

10:20 it looks like USDJPY going up first .. put a hedge on iam not so convinced yet .. as we still in the channel things may reverse at any time to the original way down.

DXY still not decided where it’s want to go, but it looks like my assumption of this morning will become real.

14:50 Whipsawed myself a few times on USDJPY .. now have a hedge on agter closing a large number of trades to pay for all the losses i generated before.

14:50 Whipsawed myself a few times on USDJPY .. now have a hedge on agter closing a large number of trades to pay for all the losses i generated before.

15:00 putting a hedge on the current USDJPY Trade .. (have to jump out for a bit)

19:44 finally try to get rid of the old hedge .. whipsawed myself, twice .. so we call it a day with a 1.42% Loss.

Full Article