Articles

The Fed put and the Trump put may both be gone

March 30, 2025 02:39 Forexlive Latest News Market News

Shortly after the election, markets were in a great mood and it’s easy to see why. You had a Republican sweep with the promise to extend current tax cuts and maybe even deliver more. Since then, the tough math on the US deficit has eroded some of that optimism and Congress hasn’t moved particularly quick. That’s raising some questions on the fiscal front but two other questions loom large.

1) The Trump Put

In his first term, Trump was obsessed with the stock market. Even in the depths of covid, he treated it like a personal scorecard, always bragging about it or blaming declines on others. Ultimately, it led to nice gains throughout his term despite all the usual Trump rhetoric. The Trump put was the idea that he didn’t really mean most of the things he said and that keeping stock markets and GDP growth high was the overriding goal. That was the Trump put.

In his first two months in office, Trump 2.0 has been different. Members of his cabinet are talking about a detox and short-term pain. He still references the stock market but is also doing and threatening things that are problematic. The 10% drop in the S&P 500 since February speaks for itself.

I don’t think the Trump put is gone but it certainly doesn’t look as strong.

2) The Fed put

In his first term, Trump started with relatively low stock market valuations and ample fiscal space. He played that hand well. This time, he arrived with high valuations and a high deficit — not so pretty. One improvement though was the Fed, the autumn cuts put some juice into the economy but more importantly, with Fed funds at 4.25-4.50%, there was plenty of room to cut. The market was also seeing falling inflation and a long runway, particularly if anything went wrong in the economy.

Now it’s less clear that ammunition is available. This week we saw the Fed’s Musalem crack open the door to rate hikes, while Daly indicated she was losing confidence in her forecast for two cuts this year. Today’s inflation numbers were slightly hotter than expected and there is a growing possibility that the Fed won’t be able to cut at all — even if the economy stumbles. The Fed put might be gone.

Now much of this is Trump’s own doing with tariffs but it’s illustrative of why stock markets are struggling and could fall further.

This article was written by Adam Button at www.forexlive.com.

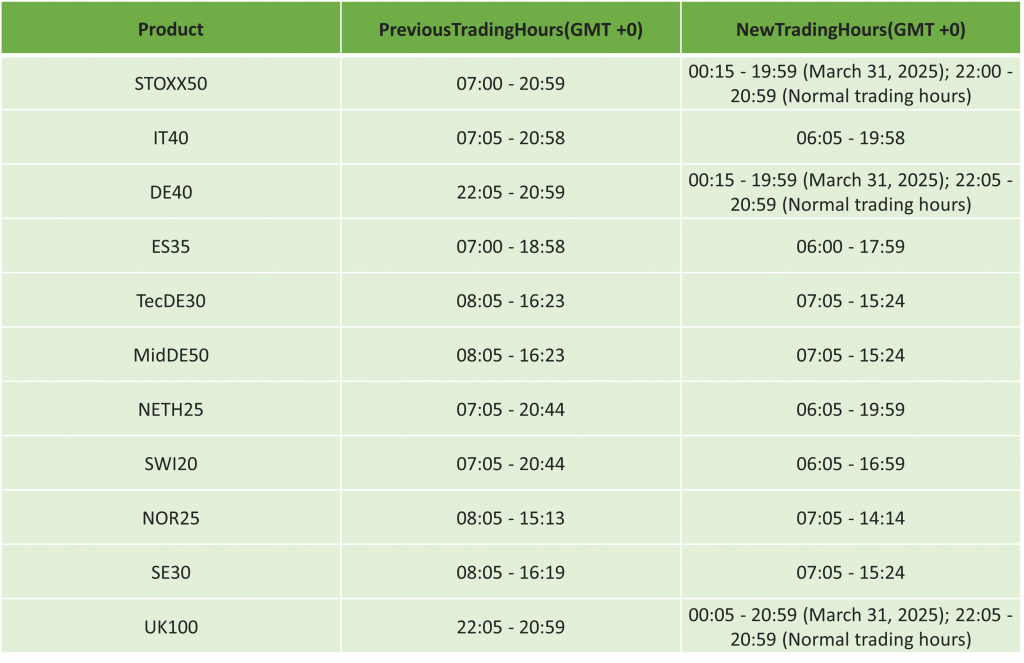

Europe Daylight Savings : Updated Trading Schedule 2025

March 29, 2025 17:14 ICMarkets Market News

Dear Client,

As part of our commitment to providing the best trading experience to our clients, we want to inform you there will be an adjustment in the trading schedule due to the Europe entering Daylight Savings on Sunday, 30 March 2025.

While trading, most products will remain unaffected; however, there will be a change in the trading hours of some products.

All times mentioned below are expressed as Platform time (GMT +3) except for cTrader (GMT +0).

MT4/5:

Commodity Futures:

Bonds:

Shares:

cTrader:

For any further assistance, please contact our Support Team.

Kind regards,

IC Markets Global.

The post Europe Daylight Savings : Updated Trading Schedule 2025 first appeared on IC Markets | Official Blog.

Nomura: Beijing’s cautious tariff response is pragmatic amid limited import alternatives

March 29, 2025 08:14 Forexlive Latest News Market News

I saw this from Nomura on Friday and am a wee bit slow to post it. here it is now.

–

With U.S.–China trade tensions expected to escalate following the Trump administration’s latest “America First” policy review, China’s measured response to new U.S. tariffs appears to be a calculated move, according to Nomura.

In a report led by Chief China Economist Lu Ting, Nomura analysed China’s capacity to replace U.S. imports with goods from other countries. While there are some substitution options for items like LNG, engine parts, and scrap copper, the range is narrow. For key imports such as soybeans, semiconductors, crude oil, and aircraft, viable alternatives are either limited or would take years to scale.

Against this backdrop, Nomura says Beijing’s restrained reaction to a recent 20% U.S. tariff makes strategic sense. Any aggressive retaliation risks harming China’s own economy given its reliance on certain U.S. goods.

With few easy trade-offs available, Nomura concludes that a cautious approach helps China preserve economic stability while managing growing geopolitical and trade pressures.

This article was written by Eamonn Sheridan at www.forexlive.com.

Elon Musk sells Twitter to xAI

March 29, 2025 04:39 Forexlive Latest News Market News

Elon Musk is combining X (formerly Twitter) and xAI (his AI company that’s known for Grok).

The deal puts X under xAI with the transaction valuing X at $33 billion. That’s a 33% discount to the $44 billion he paid to take Twitter private, however with the debt component it might all wash out. There was a mix of debt and equity in that deal and it also included many outside investors, including Jack Dorsey.

Presumably, they are on board with combining the companies and leaving former Twitter investors with a much smaller stake. The merger numbers valued xAI at $80 billion.

The combination makes sense with Grok embedded in Twitter, though I’m not sure the valuation of xAI makes sense in a world where DeepSeek can do what Grok can and it’s open source.

Funnily enough, because of problems with Twitter today, it’s hard to see the tweet where Elon Musk confirms it.

It says:

@xAI has acquired @X in an all-stock transaction. The combination values xAI at $80 billion and X at $33 billion ($45B less $12B debt).

Since its founding two years ago, xAI has rapidly become one of the leading AI labs in the world, building models and data centers at unprecedented speed and scale.

X is the digital town square where more than 600M active users go to find the real-time source of ground truth and, in the last two years, has been transformed into one of the most efficient companies in the world, positioning it to deliver scalable future growth.

I would love to know what went on behind the scenes to make this deal happen. I would much rather own 10% of Twitter than 2.9% of the combined companies.

This article was written by Adam Button at www.forexlive.com.

Forexlive Americas FX news wrap: US dollar slides despite risk rout. Another gold record

March 29, 2025 04:30 Forexlive Latest News Market News

- US February PCE core +2.8% y/y vs +2.7% expected

- UMich March final consumer sentiment 57.0 vs 57.9 expected

- Trump drops the ‘governor’ talk and says he had ‘extremely productive’ call with Carney

- Canada PM Carney: Canada will implement retaliatory tariffs

- Trump says will “absolutely” follow through with tariff promise on Canada

- Trump says he is willing to make deals on tariffs

- Carney: Trump did not give any guarantees he would back down on tariffs

- Vance on Greenland: Denmark has not done a good job

- Fed’s Daly: Today’s data confirms her decreased confidence in outlook

- The Trump admin is considering higher taxes on the rich – report

- Trump says his preference is to work things out with Iran

- Canada GDP for January 0.4% vs 0.3% estimate

- EU floats concessions to White House but expects 10-25% tariff rate

- Fed’s Daly: Two rate cuts still reasonable for 2025

- Atlanta Fed GDPNow -2.8% vs -1.8% prior

- NY Fed GDP tracker paints a different picture

- ECB’s Nagel: The inflation numbers I’ve seen recently are encouraging

Markets

- S&P 500 down 2.0%

- WTI crude oil down 84-cents to $69.08

- US 10-year yields down 12 bps to 4.25%

- Gold up $28 to $3084

- JPY leads, NZD lags

What’s worrisome about today’s price action was that there was a fair bit of good news. Yes, UMich was poor and the spending in PCE stumbled but there were positive future indications. 1) Trump cooled things down with Canada 2) The EU floated some trade concessions 3) PCE inflation was only fractionally higher than expected.

Despite that, there was rout in equities that spilled over into a 125 pip decline in USD/JPY and a bruising day in equity markets.

The easy target is angst about April 2. At this point, the weak hands are getting shaken out and the buyers are waiting for the smoke to clear. Yes, maybe there were some nice comments about Canada and negotiating tariff deals more broadly, but it’s Trump and he’s unpredictable. I get that and that’s understandable, even if the drastic worsening of sentiment in the past 9 hours isn’t.

What I worry about in the bigger picture — especially in light of some positive headlines — is that the Trump administration is losing the benefit of the doubt. I still think there is a ‘Trump put’ but they’re playing such a dangerous game with trade and the economy that it could blow up in their face. Plenty of things can go wrong here and that could lead to a much harder landing.

Also notable is that the US dollar struggled today, despite a brutal selloff in stocks. That highlights are market that’s pulling money out of the USA on an uncertain outlook. Today the CoreWeave IPO would have busted if some big partners hadn’t stepped in and Lululemon had a poor guide that saw the stock fall 14%.

Overall, it was a headline-heavy day and next week is chalk-full of risk events so it won’t get any easier. Have a great weekend.

This article was written by Adam Button at www.forexlive.com.

Trump says he is willing to make deals on tariffs

March 29, 2025 03:30 Forexlive Latest News Market News

- Says he will be announcing pharma tariffs soon

I don’t know if this tells us much.

This article was written by Adam Button at www.forexlive.com.

Carney: Trump did not give any guarantees he would back down on tariffs

March 29, 2025 03:30 Forexlive Latest News Market News

I would like to know the context of this quote, in particular the question that was asked because some subtitles could be important.

- Carney says Trump respected Canada’s sovereignty today both in private and public comments

- Talk with Trump was very cordial

- It’s not clear whether there will be new trade discussions between Canada, the US and Mexico

- It’s the preference of Canada that Mexico would be included

- Says he will meet Trump

- Canada’s system of agriculture supply management will never be on the table in talks with the US

This article was written by Adam Button at www.forexlive.com.

US equity close: Not a pretty picture as tariff fears weigh

March 29, 2025 03:14 Forexlive Latest News Market News

The pre-market picture wasn’t bad at all but some softness in the consumer spending portion of the PCE report and another weak consumer sentiment print weighed. I would suspect those were small factors though compared to worries about tariffs. No one from the White House came out to talk down auto tariffs or April 2 tariffs ahead of a critical week. I suspect we will see some of that in the days ahead but it’s a dicey moment and many are headed to the sidelines.

- S&P 500 -2.0%

- Nasdaq Comp -2.7%

- DJIA -1.7%

- Russell 2000 -2.2%

- Toronto TSX Comp -1.6%

On the week:

- S&P 500 -1.5%

- Nasdaq Comp -2.6%

- DJIA -1.0%

- Russell 2000 -1.8%

- Toronto TSX Comp -0.8%

In the quarter (with one day left)

- S&P 500 -5.2%

- Nasdaq Comp -10.3%

- Russell 2000 -1.7%

- Toronto TSX Comp +0.2%

Aside from the trade worries, the tech picture doesn’t look healthy. Nvidia was down another 1.6% today and off almost 10% this week. The first phase of any technological boom is always the ‘picks and shovels’ but we may be past that point now with people finding ways to make LLMs cheaper and more efficient. There is a trough afterwards until the second phase of a massive productivity boom starts to unfold.

All told, this will likely be the worst quarter for the S&P 500 since the third quarter of 2022.

This article was written by Adam Button at www.forexlive.com.

Three reasons why trade tensions between Canada and the US should drop

March 29, 2025 02:00 Forexlive Latest News Market News

Today might have been a turning point in Trump’s relationship with Canada though many would argue that it’s now beyond repair. Yesterday Canadian Prime Minister Mark Carney said:

“The old relationship we had with the United States, based on deepening

integration of our economies and tight security and military

cooperation, is over.”

Today though, Trump took a different tone with Canada, dropping the 51st State talk and didn’t address the PM as ‘governor’ while saying that there would be a good deal for the US and Canada.

I suspect the relationship has bottomed and that’s a big opportunity in many trades. That said, it’s difficult to have conviction in that call given all the unpredictability in the Trump 2.0 administration.

People outside of Canada don’t understand just how wounded the country feels but some data this week highlighted it with forward airline bookings to the US down 70% out to September. People also don’t seem to understand how phoney the talk of Canadian fentanyl and tariffs are.

Some facts:

1) Canadian tariffs don’t exist

The US-Canadian relationship is one of the all-time great truly free trade agreements. The average tariff rate of US goods going into Canada is 1.1%, per the WTO. So if they US wants to actually do reciprocal trade, then that would be fine.

Now you see some stupid charts floating around the internet about dairy and cheese tariffs but it’s nonsense. For one, every country protects and subsidizes their farmers (and perhaps none more than the USA). These are also very small parts of US-Canada trade and were negotiated in USMCA.

2) Canada doesn’t have a manufactured goods surplus with the US

Here’s a great chart from TD that illustrates that basically the entire trade surplus that Canada currently has with the US is energy — all in the form of highly-discounted oil and natural gas.

Ex-energy, the US has had a surplus with Canada for every year this century.

If you want to look at autos alone, the US currently enjoys a surplus in auto trade with Canada. Note that this chart also excludes services exports, where the US also enjoys a surplus of around $15 billion.

3) Based on the size of trade, the US deficit is small

Using US Census Bureau figures, the US total trade deficit with Canada of roughly US$45 billion in 2024, or a mere -0.2% of US GDP. It’s 4% of the overall US trade deficit.

Despite all of this, you have Trump repeatedly saying things like “we are subsidizing Canada by $200 billion a year”. Neither he nor the White House have ever indicated how this math makes any sense.

What’s the strategy here?

It’s hard to comprehend any kind of strategy, unless you believe in the 51st State line. Perhaps this is an extremely-aggressive escalation in rhetoric and some short-term tariffs in order to extract a slightly better trade deal. That’s my base case but it’s looking more and more like a foolish strategy that ultimately benefits no one.

I’ll be on BNNBloomberg on Monday morning talking about some of this. Tune in.

This article was written by Adam Button at www.forexlive.com.

Vance on Greenland: Denmark has not done a good job

March 29, 2025 01:30 Forexlive Latest News Market News

- Says Denmark has underinvested in security architecture in Greenland

- Will respect the self-determination of Greenlanders

- Greenland is less secure than it was 30, 40 years ago

He’s right about Greenland being less secure but he’s not right about who it’s less secure from.

That said, the ‘self-determination’ line is the most-dovish thing anyone in the White House has said about Greenland. Joining the US for them polls at about 10%.

This article was written by Adam Button at www.forexlive.com.

The Trump admin is considering higher taxes on the rich – report

March 29, 2025 01:00 Forexlive Latest News Market News

An Axios report says the Trump admin is considering allowing the richest Americans’ tax rates to rise in return for cutting taxes on tips.

There isn’t much here as it says “some White House officials believe” it would be a good idea. Note that this would have to get through Congress and it would take the top rate to 39.6% from 37% and also lower the threshold for when that kicks in.

Aside from the obvious political problems in raising taxes for the rich, I can’t understand how removing taxes on tips might work as it presents an infinite number of loopholes.

This article was written by Adam Button at www.forexlive.com.

Trump says his preferrence is to work things out with Iran

March 29, 2025 00:39 Forexlive Latest News Market News

- Told Iran they need to make a decision

- Iran is on his list of things to watch

- Is looking at reports of Iranian drones used in Ukraine

Trump gave Iran some deadlines about its nuclear program at the start of his term and this was reportedly the response:

1. Iran reaffirms that it will not negotiate directly with the United States, especially under the policy of maximum pressure, and it rejects the American approach categorically.

2. Iran states that it does not negotiate on behalf of any regional power, and that Iran does not dictate the foreign policy of other nations or groups, including Yemen’s Ansarallah, which is an independent ally.

3. Iran states that it will not accept Trump’s ‘unrealistic conditions’, and that the U.S. demands were so extensive that they cannot be entertained even hypothetically.

4. Iran warns unequivocally that any military or hostile action, whether by the United States or any of its ‘stooges’, will be met with an Iranian response that will encompass all U.S. military assets in the Middle East.

It’s really hard to guess where this is going.

This article was written by Adam Button at www.forexlive.com.