Articles

General Market Analysis – 01/04/25

414243 April 1, 2025 07:39 ICMarkets Market News

Mixed Markets Ahead of Tariff Call – Dow up 1%

US stocks experienced a mixed day ahead of key tariff updates and data later this week. The Dow added 1%, the S&P rose 0.55%, while the Nasdaq dropped 0.14%. Treasury yields dropped again after their sharp fall on Friday, the 2-year down 2.9 basis points to 3.883%, and the 10-year down another 4.4 basis points to 4.205%. The dollar crept higher against the majors, with the DXY up 0.16% to 104.17. Oil prices surged higher as supply concerns increased, with President Trump looking to impose more tariffs on Russia and possibly attack Iran. Brent rose 2.71% to $74.73, and WTI gained 3.06% to $71.48 a barrel. Gold again drove higher as haven flows pushed it to new record levels, gaining 1.23% on the day to close at $3,123.33 an ounce.

Tariff “Liberation Day” – How Hard Will They Go

Investors and traders alike are focusing strongly on developments in Washington DC regarding Trump’s reciprocal trade tariffs and how hard the new US administration will go to ‘even things out’. Some estimates in the market suggest that a harder tariff stance could add up to 28% to the average tariff rate, potentially hitting US GDP by as much as 4% and lifting prices by 2.5%, resulting in a $1 trillion drop in US output. These are, of course, huge numbers and based on estimates, but the impact on the US economy – and therefore the global economy – could be substantial. Many investors are hoping for a much softer update on Wednesday, with announcements likely to hit markets after the Asian open, when most products will suffer from lower liquidity. In general, however, most traders expect the updates to trigger even more volatility across markets before the dust settles – and even then, they are not convinced we will have a clear path ahead.

Rate Calls and Data Ahead but Tariffs to Dominate

It is a busy day on the macroeconomic calendar today, which will keep traders focused from a fundamental perspective. However, all market participants are aware of the tariff updates due on Wednesday from President Trump, and most expect their impact to dominate. There is a very strong focus on Australian markets to kick off the day today, with Retail Sales data (exp. +0.3% m/m) due out in the morning session and the Reserve Bank rate call in the afternoon. The RBA rate call is set to dominate sentiment, and they are firmly expected to keep rates on hold after January’s “hawkish cut”, with traders expecting to see moves on the back of the Bank’s updates in the statement and the later press conference. The focus will shift to the EU once the London market opens, with key CPI data due and a scheduled speech from ECB President Christine Lagarde. The New York session sees the first (of many) tier-one US data updates today, with ISM Manufacturing PMI data (exp. 49.5) and the JOLTS Job Openings (exp. 7.9 million) the pick of the bunch. However, once again, most traders expect any tariff talk to outweigh the impact of the data in the short term.

The post General Market Analysis – 01/04/25 first appeared on IC Markets | Official Blog.

Trade the Aussie Dollar on the RBA Rate Decision

414231 April 1, 2025 05:14 ICMarkets Market News

Aussie dollar traders are preparing for a busy day today, with some key data due this morning before the Reserve Bank announces its latest interest rate decision. Retail Sales data is due out in the morning session today, with expectations for a 0.3% month-on-month increase. Anything significantly off that will see more moves in the currency; however, this afternoon’s rate call from the central bank and guidance from the statement and press conference are likely to have a bigger impact on the market.

The majority of economists are expecting the Reserve Bank to keep rates on hold at 4.10% today, after they cut at their last meeting. Persistent inflation pressure and overall global market uncertainty, as well as an upcoming election, should see Governor Michele Bullock and her team keep rates steady. However, forward guidance, which has tended to be more hawkish during their tenure, should see some moves in the currency.

The Aussie has been under pressure recently, both against the dollar and on the crosses, with the major pair dropping nearly 2% in the last week. It is sitting just above recent monthly lows going into today’s updates, and a weaker Retail Sales print and/or more dovish sentiment from the Reserve Bank could see those levels broken in short order. Conversely, a stronger print combined with more hawkish forward guidance – which some analysts are leaning towards – could see a good rally back into the middle of the recent range.

Resistance 2: 0.6345 – Trendline Resistance

Resistance 1: 0.6345 – Trendline Resistance: 0.6292 – 200 Day Moving Average

Support 1: 0.6345 – Trendline Resistance: 0.6217 – Overnight Low and Trendline Support

Support 2: 0.6180 – March Low

The post Trade the Aussie Dollar on the RBA Rate Decision first appeared on IC Markets | Official Blog.

Ex-Dividend 1/4/2025

414203 March 31, 2025 17:14 ICMarkets Market News

|

1

|

Ex-Dividends | ||

|---|---|---|---|

|

2

|

1/4/2025 | ||

|

3

|

Indices | Name |

Index Adjustment Points

|

|

4

|

Australia 200 CFD

|

AUS200 | – |

|

5

|

IBEX-35 Index | ES35 | 2.17 |

|

6

|

France 40 CFD | F40 | – |

|

7

|

Hong Kong 50 CFD

|

HK50 | – |

|

8

|

Italy 40 CFD | IT40 | – |

|

9

|

Japan 225 CFD

|

JP225 | – |

|

10

|

EU Stocks 50 CFD

|

STOXX50 | – |

|

11

|

UK 100 CFD | UK100 | – |

|

12

|

US SP 500 CFD

|

US500 | 0.14 |

|

13

|

Wall Street CFD

|

US30 | – |

|

14

|

US Tech 100 CFD

|

USTEC | – |

|

15

|

FTSE CHINA 50

|

CHINA50 | – |

|

16

|

Canada 60 CFD

|

CA60 | 0.74 |

|

17

|

Germany Tech 40 CFD

|

TecDE30 | – |

|

18

|

Germany Mid 50 CFD

|

MidDE50 | – |

|

19

|

Netherlands 25 CFD

|

NETH25 | – |

|

20

|

Switzerland 20 CFD

|

SWI20 | – |

|

21

|

Hong Kong China H-shares CFD

|

CHINAH | – |

|

22

|

Norway 25 CFD

|

NOR25 | – |

|

23

|

South Africa 40 CFD

|

SA40 | – |

|

24

|

Sweden 30 CFD

|

SE30 | – |

|

25

|

US 2000 CFD | US2000 | 0.09 |

The post Ex-Dividend 1/4/2025 first appeared on IC Markets | Official Blog.

General Market Analysis – 31/03/25

414171 March 31, 2025 07:39 ICMarkets Market News

US Stocks Smashed Ahead of Big Week – Nasdaq down 2.7%

US stocks were smashed in trading on Friday as the inflation data came in stronger than expected and global growth concerns continued to weigh on investor sentiment. The Dow dropped 1.7%, the S&P 1.99%, while the Nasdaq took the biggest hit, losing 2.71% on the day. US Treasury yields also fell hard as flows continued into bonds; the 2-year lost 7.8 basis points to move down to 3.912%, and the 10-year fell 11 basis points to 4.249%. The dollar dropped against the usual basket of currencies, with the DXY down 0.22% to 104.04. Oil prices dipped, Brent off 0.54% to $73.63 and WTI down 0.80% to $69.36, while gold continued to power higher to notch up more fresh highs, up 0.91% to $3,084.19 an ounce.

Data vs Tariffs in the Week Ahead

Fundamental data will go head-to-head with geopolitical news in the week ahead to see which will dominate investor sentiment. All eyes are, of course, on the US markets, and this week could prove to be pivotal in shaping the way forward for markets for the next quarter, if not the rest of the year, as we get key updates from the US government on tariffs, as well as some major data updates, including the key US employment data on Friday. Geopolitical updates have definitely been having the biggest impact on market moves over the last few weeks, but if we can start to see some certainty in US plans this week, we could see fundamental updates starting to factor more strongly. Most traders, however, feel that we are probably in for more volatility in the short term at least—this week especially—if data prints are off expectations and combine with newswire headlines on trade and tariffs.

Busy Trading Day to Kick off a Big Trading Week

Traders are bracing for more volatility in the sessions and days ahead this week, and comments from President Trump over the weekend in the US have already seen some moves on the Asian open today. The macroeconomic event calendar also has plenty of scheduled data, which should add to the mix. The initial focus in the Asian session today will be on Chinese markets, with key Manufacturing and Non-Manufacturing PMI data due out; expectation is for prints of 50.4 and 50.5 respectively, and anything significantly off these should see further moves in markets. Key German inflation numbers are due out in the London session today, with the individual German states reporting their CPI data separately across the day. Expectation is for the final number to show a 0.3% month-on-month increase. There isn’t much on the cards in the US session today, with just the Chicago PMI data out, so expect geopolitical updates to dominate again before we see more major data updates in the States as we progress through the week.

The post General Market Analysis – 31/03/25 first appeared on IC Markets | Official Blog.

The Week Ahead – Week Commencing 31 March 2025

414157 March 31, 2025 06:00 ICMarkets Market News

It is another potentially massive week for global markets in general, and US markets in particular, with key jobs numbers due out from the US across the week and a pivotal day for tariffs on 2 April.

There is a heavy focus on US data as we move through the week, with jobs data prominent, culminating in the key Non-Farms numbers on Friday.

There are some other key updates across other markets as well, but investors are once again expecting a heavy influence on markets from the US, both from a fundamental data perspective as well as from the expected trade updates.

Here is our usual day-by-day breakdown of the major risk events this week:

The week kicks off with an early focus on Chinese markets in the Asian session, with Manufacturing and Non-Manufacturing PMI numbers due out. The European session will see the focus on Germany, with all individual states reporting the CPI updates during the day, whilst the New York session has little on the cards in terms of data releases.

There is a big focus on Australian markets on Tuesday in the Asian session, with Retail Sales numbers out early in the day before the key Reserve Bank of Australia Rate Decision and Press Conference in the afternoon. There is more inflation data due out in Europe, with the EU CPI numbers due for release, and then we have the first major US data of the week once New York opens. ISM Manufacturing PMI and JOLTS Job Openings data are due out early in the session, with the JOLTS data likely to have the slightly bigger impact.

The quietest day of the week in terms of scheduled market events, with just the US ADP Non-Farms Employment data the only major release of the day. However, it could be one of the busiest days for traders, with the market expecting to get more clarity on tariffs from President Trump.

There is little of note on the calendar again in the Asian session, but traders are expecting a busy day on the back of tariff updates from the States and counter-tariff plans from affected countries. There will be a big focus on Swiss markets shortly after the London open, with the latest CPI data due out, and there is more key US data due out in the New York session, with the Weekly Unemployment Claims numbers out alongside the ISM Services PMI and Final Services PMI data.

It’s Non-Farms Payroll Day on Friday, and the schedule looks likely to set the market up for a classic calm-before-the-storm-type day. There is nothing of note again in the Asian session scheduled, and just the UK Construction PMI numbers in the European day, which should see relatively rangebound conditions (barring, of course, any big geopolitical news) into the big US employment numbers. The Unemployment Rate and Average Hourly Earnings data are out alongside the headline Non-Farms number, but as always, expect the headline number to dominate the initial market reaction. Canadian employment data is again out at the same time as the US numbers, but expect the moves to come on the back of the US updates.

The post The Week Ahead – Week Commencing 31 March 2025 first appeared on IC Markets | Official Blog.

Europe Daylight Savings : Updated Trading Schedule 2025

414142 March 29, 2025 17:14 ICMarkets Market News

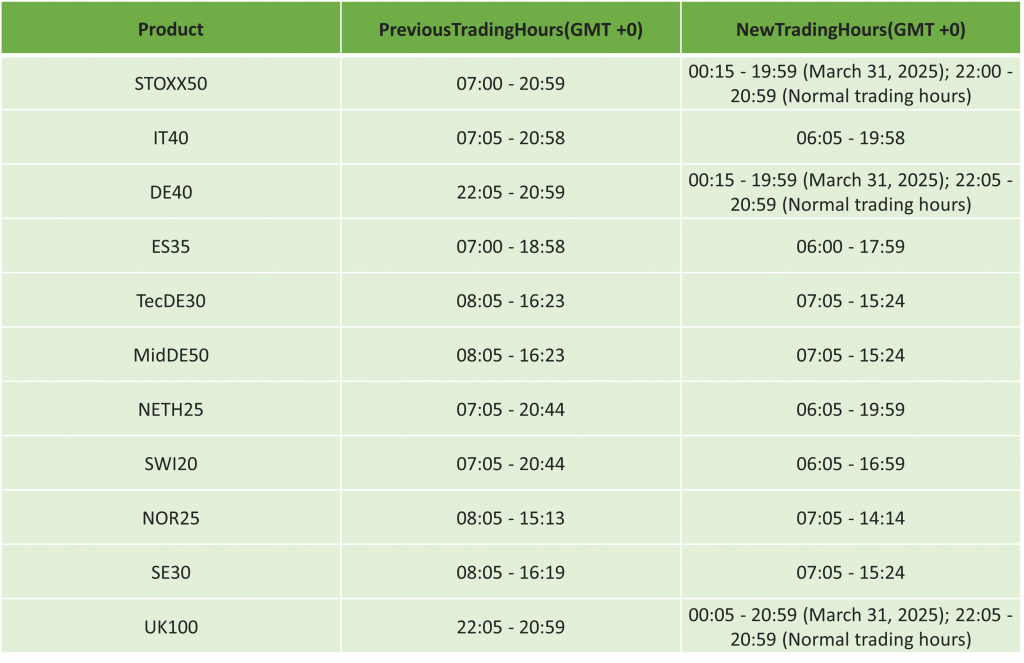

Dear Client,

As part of our commitment to providing the best trading experience to our clients, we want to inform you there will be an adjustment in the trading schedule due to the Europe entering Daylight Savings on Sunday, 30 March 2025.

While trading, most products will remain unaffected; however, there will be a change in the trading hours of some products.

All times mentioned below are expressed as Platform time (GMT +3) except for cTrader (GMT +0).

MT4/5:

Commodity Futures:

Bonds:

Shares:

cTrader:

For any further assistance, please contact our Support Team.

Kind regards,

IC Markets Global.

The post Europe Daylight Savings : Updated Trading Schedule 2025 first appeared on IC Markets | Official Blog.

Ex-Dividend 31/3/2025

414103 March 28, 2025 16:39 ICMarkets Market News

|

1

|

Ex-Dividends | ||

|---|---|---|---|

|

2

|

31-03-25 | ||

|

3

|

Indices | Name |

Index Adjustment Points

|

|

4

|

Australia 200 CFD

|

AUS200 | |

|

5

|

IBEX-35 Index | ES35 | |

|

6

|

France 40 CFD | F40 | |

|

7

|

Hong Kong 50 CFD

|

HK50 | |

|

8

|

Italy 40 CFD | IT40 | |

|

9

|

Japan 225 CFD

|

JP225 | |

|

10

|

EU Stocks 50 CFD

|

STOXX50 | |

|

11

|

UK 100 CFD | UK100 | |

|

12

|

US SP 500 CFD

|

US500 | 0.58 |

|

13

|

Wall Street CFD

|

US30 | |

|

14

|

US Tech 100 CFD

|

USTEC | 0.98 |

|

15

|

FTSE CHINA 50

|

CHINA50 | |

|

16

|

Canada 60 CFD

|

CA60 | 1.14 |

|

17

|

Germany Tech 40 CFD

|

TecDE30 | |

|

18

|

Germany Mid 50 CFD

|

MidDE50 | |

|

19

|

Netherlands 25 CFD

|

NETH25 | |

|

20

|

Switzerland 20 CFD

|

SWI20 | 8.9 |

|

21

|

Hong Kong China H-shares CFD

|

CHINAH | |

|

22

|

Norway 25 CFD

|

NOR25 | |

|

23

|

South Africa 40 CFD

|

SA40 | |

|

24

|

Sweden 30 CFD

|

SE30 | 1.95 |

|

25

|

US 2000 CFD | US2000 | 1.04 |

The post Ex-Dividend 31/3/2025 first appeared on IC Markets | Official Blog.

Friday 28th March 2025: Asia-Pacific Markets Slip Amid U.S. Tariff Concerns

414089 March 28, 2025 13:39 ICMarkets Market News

Global Markets:

- Asian Stock Markets : Nikkei down 2.26%, Shanghai Composite down 0.38%, Hang Seng down 1.03% ASX up 0.16%

- Commodities : Gold at $3116.35 (0.80%), Silver at $35.3 (0.48%), Brent Oil at $73.05 (-0.15%), WTI Oil at $69.6 (-0.14%)

- Rates : US 10-year yield at 4.337, UK 10-year yield at 4.7880, Germany 10-year yield at 2.7735

News & Data:

- (USD) Final GDP q/q 2.4% to 2.3% expected

- (USD) Unemployment Claims 224K to 225K expected

Markets Update:

Most Asia-Pacific markets fell on Friday as U.S. President Donald Trump’s tariff threats unsettled investors. Japan’s Nikkei 225 dropped 2.09%, reaching a two-week low, while the Topix fell 2.19%. South Korea’s Kospi declined 1.76%, and the small-cap Kosdaq lost 1.44%. Hong Kong’s Hang Seng Index slipped 0.41%, while China’s CSI 300 dipped 0.25%. Australia’s S&P/ASX 200, however, rose 0.36% after Prime Minister Anthony Albanese announced a national election for May 3.

Investor attention remains on automakers after Trump’s announcement of 25% tariffs on all cars not manufactured in the U.S. Automaker stocks slid on Thursday in response. However, Trump later suggested the April 2 tariffs would be “very lenient” and even hinted at easing tariffs on China to facilitate a deal with ByteDance’s TikTok. Trump also signaled a willingness to impose even higher tariffs on the European Union and Canada if they oppose U.S. trade policies. These remarks have heightened market uncertainty.

U.S. stock futures remained little changed as investors weighed the impact of ongoing trade tensions. Overnight, major U.S. indices closed lower. The Dow Jones Industrial Average lost 155.09 points (0.37%) to 42,299.70. The S&P 500 declined 0.33% to 5,693.31, while the Nasdaq Composite fell 0.53% to 17,804.03.

With trade policy uncertainty persisting, markets will likely remain volatile in the coming sessions.

Upcoming Events:

- 12:30 PM GMT – CAD GDP m/m

- 12:30 PM GMT – USD Core PCE Price Index m/m

The post Friday 28th March 2025: Asia-Pacific Markets Slip Amid U.S. Tariff Concerns first appeared on IC Markets | Official Blog.

IC Markets Europe Fundamental Forecast | 28 March 2025

414088 March 28, 2025 13:39 ICMarkets Market News

IC Markets Europe Fundamental Forecast | 28 March 2025

What happened in the Asia session?

Japan’s Tokyo Core CPI accelerated from an annual rate of 2.2% in the previous month to 2.4% in March, higher than the market consensus of 2.2%. This marks the fifth consecutive month that core inflation has remained above the Bank of Japan’s (BoJ) 2% target, reinforcing expectations that the central bank will continue normalizing monetary policy. The BoJ held interest rates steady during its March policy meeting as the board took a cautious stance while assessing the impact of rising global risks on the domestic economy. However, Governor Kazuo Ueda signalled this week that further rate hikes are likely if economic conditions align with projections. The yen initially strengthened following this data release with USD/JPY falling toward 150.70 but it reversed swiftly to rise steadily toward 151.20 at the beginning of this session – this currency pair was floating around 150.80 by midday in Asia.

What does it mean for the Europe & US sessions?

After declining for four consecutive months, consumer spending in the U.K. rebounded strongly in January as sales jumped 1.7% MoM, easily surpassing market expectations of a 0.3% gain. This marked the strongest expansion since May 2024, with food stores such as supermarkets, specialist food stores as well as alcohol and tobacco stores leading the gains. However, February forecast points to a decline of 0.3%, signalling a return to negative sales growth. Weaker-than-expected consumer spending could create headwinds for the pound on the final trading day of the week.

Economic activity grew relatively strongly in December 2024 and January of this year as mining, quarrying and oil and gas extraction activities along with wholesale trade and transportation; and warehousing led the expansion. Following a growth of 0.3% in January, the Loonie should see strong tailwinds if Canada’s economy remains robust.

The Dollar Index (DXY)

Key news events today

PCE Price Index (12:30 pm GMT)

What can we expect from DXY today?

The PCE Price Index – which is the Federal Reserve’s preferred gauge of inflation – moderated lower in January as both headline and core readings eased, marking its first slowdown in four months. Should inflationary pressures continue to dissipate further in February, this recent ascend in the DXY could lose some steam during the U.S. trading hours.

Central Bank Notes:

- The Board of Governors of the Federal Reserve System voted unanimously to maintain the Federal Funds Rate in a target range of 4.25 to 4.50% on 19 March 2025

- The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run but uncertainty around the economic outlook has increased; the Committee is attentive to the risks to both sides of its dual mandate.

- Recent indicators suggest that economic activity has continued to expand at a solid pace while the unemployment rate has stabilized at a low level in recent months, and labour market conditions remain solid. However, inflation remains somewhat elevated.

- GDP growth forecasts were revised downward for 2025 (1.7% vs. 2.1% in the December projection) while PCE inflation projections have been adjusted slightly higher for 2025, with core inflation expected to reach 2.5%, partly due to tariff-related pressures.

- In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook and is prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of its goals.

- Beginning in April, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25B to $5B while maintaining the monthly redemption cap on agency debt and agency mortgage-backed securities at $35B.

- The next meeting is scheduled for 6 to 7 May 2025.

Next 24 Hours Bias

Medium Bullish

Gold (XAU)

Key news events today

PCE Price Index (12:30 pm GMT)

What can we expect from Gold today?

The PCE Price Index – which is the Federal Reserve’s preferred gauge of inflation – moderated lower in January as both headline and core readings eased, marking its first slowdown in four months. Should inflationary pressures continue to dissipate further in February, this recent ascend in the DXY could lose some steam during the U.S. trading hours, potentially providing a boost for gold prices.

Next 24 Hours Bias

Medium Bullish

The Australian Dollar (AUD)

Key news events today

No major news events.

What can we expect from AUD today?

The Aussie has hovered around 0.6300 for most of this week but downward pressures are driving it toward 0.6270 at the beginning of Friday’s Asia session. Persistent demand for the greenback will likely weigh on the Aussie as the day progresses.

Central Bank Notes:

- The RBA reduced the cash rate by 25 basis points to bring it down to 4.10% on 18 February, marking the first rate cut since November 2020.

- Financial conditions are restrictive, which is weighing on demand and is helping to bring down underlying inflation; growth in private demand has been subdued.

- Underlying inflation has moderated over the past three quarters with trimmed mean inflation easing to 3.2% over 2024 and it is expected to reach the 2–3% target range in early 2025, which is sooner than expected at the time of the November Statement.

- The unemployment rate declined a little in late 2024 to 4% with much of the strength in the labour market underpinned by strong employment growth, which has also bolstered household incomes.

- The announcement of tariffs between the United States and other major economies poses challenges to the global outlook but the scale and incidence of the tariffs and their effects remain highly uncertain – which may itself delay some investment until the outlook becomes clearer.

- Economic activity strengthened in China but growth there is still facing structural headwinds while domestic economic growth is forecast to pick up and the labour market is forecast to remain tight.

- If the cash rate follows the market path, underlying inflation is projected to be a little above 2.5% over most of the forecast period. The anticipated recovery of GDP growth and lingering tightness in labour market conditions are expected to sustain some upward pressure on inflation.

- Sustainably returning inflation to target within a reasonable timeframe remains the Board’s highest priority. This is consistent with the RBA’s mandate for price stability and full employment.

- The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions, paying close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market.

- The next meeting is on 1 April 2025.

Next 24 Hours Bias

Weak Bearish

The Kiwi Dollar (NZD)

Key news events today

No major news events.

What can we expect from NZD today?

Renewed demand for the greenback on Friday put downward pressure on the Kiwi. Overhead pressures are likely to build further as the day progresses and this currency pair could retest this week lows of 0.5700.

Central Bank Notes:

- The Monetary Policy Committee (MPC) agreed to reduce the Official Cash Rate (OCR) by 50 basis points bringing it down to 3.75% on 19 February, marking the fourth consecutive rate cut.

- The Committee assessed that annual consumer price inflation remains near the midpoint of the MPC’s 1 to 3% target band; inflation expectations are at target and core inflation continues to fall towards the target mid-point.

- Economic activity in New Zealand remains subdued and with spare productive capacity, domestic inflation pressures continue to ease. Price and wage-setting behaviours are adapting to a low-inflation environment while the price of imports has fallen, also contributing to lower headline inflation.

- Economic growth is expected to recover during 2025 as lower interest rates will encourage spending, although elevated global economic uncertainty is expected to weigh on business investment decisions. Higher prices for some key commodities and a lower exchange rate will increase export revenues and employment growth is expected to pick up in the second half of the year as the domestic economy recovers.

- Global economic growth is expected to remain subdued in the near term as geopolitics, including uncertainty about trade barriers, is likely to weaken global growth. Global economic activity is also likely to remain fragile over the medium term given increasing geoeconomic fragmentation.

- Consumer price inflation is expected to be volatile in the near term, due to a lower exchange rate and higher petrol prices. Nevertheless, the Committee is well placed to maintain price stability over the medium term.

- The economic outlook remains consistent with inflation remaining in the band over the medium term, giving the Committee confidence to continue lowering the OCR. If economic conditions continue to evolve as projected, the Committee has scope to lower the OCR further through 2025.

- The next meeting is on 9 April 2025.

Next 24 Hours Bias

Medium Bearish

The Japanese Yen (JPY)

Key news events today

Tokyo Core CPI (11:30 pm GMT 27th March)

What can we expect from JPY today?

Japan’s Tokyo Core CPI accelerated from an annual rate of 2.2% in the previous month to 2.4% in March, higher than the market consensus of 2.2%. This marks the fifth consecutive month that core inflation has remained above the Bank of Japan’s (BoJ) 2% target, reinforcing expectations that the central bank will continue normalizing monetary policy. The BoJ held interest rates steady during its March policy meeting as the board took a cautious stance while assessing the impact of rising global risks on the domestic economy. However, Governor Kazuo Ueda signalled this week that further rate hikes are likely if economic conditions align with projections. The yen initially strengthened following this data release with USD/JPY falling toward 150.70 but it reversed swiftly to rise steadily toward 151.20 at the beginning of this session – this currency pair was floating around 150.80 by midday in Asia.

Central Bank Notes:

- The Policy Board of the Bank of Japan decided on 19 March, by a unanimous vote, to maintain the following guidelines for money market operations for the inter-meeting period:

- The Bank will encourage the uncollateralized overnight call rate to remain at around 0.5%.

- The Bank will continue its plan to reduce the amount of its monthly outright purchases of JGBs, aiming to reach about 3 trillion yen by January-March 2026.

- Japan’s economy has continued to recover moderately, with some sectors showing improvement. Exports and industrial production have remained relatively stable, while corporate profits continue on an improving trend and business sentiment maintains a favourable level.

- The employment and income situation has shown moderate improvement, with private consumption on a moderately increasing trend despite ongoing impacts from price rises.

- On the price front, the year-on-year rate of increase in the consumer price index (CPI, all items less fresh food) has been in the range of 3.0-3.5% recently. Services prices continue to rise moderately, reflecting factors such as wage increases, while the effects of cost pass-through from past import price rises have diminished.

- Inflation expectations have continued to rise moderately, with underlying CPI inflation gradually increasing toward the price stability target of 2%. The virtuous cycle between wages and prices continues to strengthen, with businesses increasingly reflecting higher costs in selling prices.

- Japan’s economy is expected to maintain growth above its potential rate, supported by moderately growing overseas economies and the intensifying virtuous cycle from income to spending, underpinned by accommodative financial conditions.

- The next meeting is scheduled for 19 June 2025.

Next 24 Hours Bias

Medium Bullish

The Euro (EUR)

Key news events today

No major news events.

What can we expect from EUR today?

The euro rallied strongly on Thursday as it rose 0.5% to climb above 1.0910. However, overhead pressures remain for this currency pair as it dipped under 1.0900 as Asian markets came online on Friday.

Central Bank Notes:

- The Governing Council reduced the three key ECB interest rates by 25 basis points on 6 March to mark the fifth successive rate cut.

- Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be decreased to 2.65%, 2.90% and 2.50% respectively.

- The Council acknowledged that monetary policy was becoming meaningfully less restrictive, easing borrowing costs for businesses and households with inflation projected to average 2.3% in 2025, 1.9% in 2026, and 2.0% in 2027, while core inflation also neared the 2% target.

- Although domestic inflation remains elevated due to delayed wage and price adjustments, wage growth is moderating.

- Economic growth forecasts were revised downward to 0.9% for 2025 and 1.2% for 2026, reflecting weak exports and investment.

- The asset purchase programme (APP) and pandemic emergency purchase programme (PEPP) portfolios are declining at a measured and predictable pace, as the Eurosystem no longer reinvests the principal payments from maturing securities.

- The ECB remains data-dependent and will adjust its policy as needed to ensure inflation stabilizes around its 2% medium-term target without committing to a specific rate path.

- The next meeting is on 17 April 2025.

Next 24 Hours Bias

Medium Bearish

The Swiss Franc (CHF)

Key news events today

No major news events.

What can we expect from CHF today?

With demand for the franc and the greenback seemingly at equilibrium since last week, USD/CHF has ranged sideways as it hovered above 0.8750 while running into headwinds at 0.8850 thus far. This currency pair looks set to extend this ‘neutral’ bias as the trading week wraps up on Friday.

Central Bank Notes:

- The SNB eased monetary policy by lowering its key policy rate by 25 basis points, from 0.50% to 0.25% on 20 March 2025, marking the fifth consecutive reduction.

- Underlying inflationary pressure has decreased further this quarter.

- Inflation in the period since the last monetary policy assessment has again been lower than expected, decreasing from 0.7% in November to 0.3% in February, primarily due to lower electricity prices.

- In the shorter term, the new conditional inflation forecast is slightly higher than December: 0.3% for Q2 2025, 0.4% for 2025 overall, and 0.8% for 2026 and 2027, based on the assumption that the SNB policy rate remains at 0.25% over the entire forecast horizon.

- GDP growth in Switzerland remains moderate, with the services sector continuing to show slightly stronger growth, while manufacturing faces challenges.

- The SNB anticipates GDP growth of around 1.0% to 1.5% for 2025.

- The SNB will continue to monitor the situation closely and will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term.

- The next meeting is on 19 June 2025.

Next 24 Hours Bias

Weak Bullish

The Pound (GBP)

Key news events today

Retail Sales (7:00 am GMT)

What can we expect from GBP today?

After declining for four consecutive months, consumer spending in the U.K. rebounded strongly in January as sales jumped 1.7% MoM, easily surpassing market expectations of a 0.3% gain. This marked the strongest expansion since May 2024, with food stores such as supermarkets, specialist food stores as well as alcohol and tobacco stores leading the gains. However, February forecast points to a decline of 0.3%, signalling a return to negative sales growth. Weaker-than-expected consumer spending could create headwinds for the pound on the final trading day of the week.

Central Bank Notes:

- The Bank of England’s Monetary Policy Committee (MPC) voted by a majority of 8 to 1 to maintain the Bank Rate at 4.50% on 19 March 2025, while one member preferred to reduce it by 25 basis points (bps).

- The MPC also voted unanimously to reduce the stock of UK government bond purchases held for monetary policy purposes and financed by the issuance of central bank reserves, by £100B over the next 12 months to a total of £558B, starting in October 2024. On 18 December 2024, the stock of UK government bonds held for monetary policy purposes was £655B.

- Twelve-month CPI inflation increased to 3.0% in January from 2.5% in December, slightly higher than expected in the February Report; domestic price and wage pressures are moderating, but remain somewhat elevated.

- Although global energy prices have fallen back recently, they remain higher than last year and CPI inflation is still projected to rise to around 3.75% in 2025 Q3. While CPI inflation is expected to fall back thereafter, the Committee will pay close attention to any consequent signs of more lasting inflationary pressures.

- While UK GDP growth estimates have been slightly stronger than expected at the time of the February Monetary Policy Report, business survey indicators generally continue to suggest weakness in growth and particularly in employment intentions. In recent quarters, subdued activity has been judged to reflect both demand and supply factors.

- The labour market had continued to ease, although it was still judged to be broadly in balance – some indicators of employment intentions had deteriorated markedly, to levels consistent with shrinking employment while other indicators, such as the number of vacancies, had not weakened to the same extent.

- Domestic price and wage pressures were moderating, but remained somewhat elevated. A range of indicators suggested that underlying pay growth had eased further in recent months, although annual growth in private sector regular average weekly earnings had picked up to 6.1% in the three months to January.

- Based on the Committee’s evolving view of the medium-term outlook for inflation, a gradual and careful approach to the further withdrawal of monetary policy restraint is appropriate and it will continue to monitor closely the risks of inflation persistence and what the evolving evidence may reveal about the balance between aggregate supply and demand in the economy.

- Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further and the Committee will decide the appropriate degree of monetary policy restrictiveness at each meeting.

- The next meeting is on 8 May 2025.

Next 24 Hours Bias

Weak Bearish

The Canadian Dollar (CAD)

Key news events today

GDP (12:30 pm GMT)

What can we expect from CAD today?

Economic activity grew relatively strongly in December 2024 and January of this year as mining, quarrying and oil and gas extraction activities along with wholesale trade and transportation; and warehousing led the expansion. Following a growth of 0.3% in January, the Loonie should see strong tailwinds if Canada’s economy remains robust.

Central Bank Notes:

- The Bank of Canada reduced its target for the overnight rate by 25 basis points bringing it down to 2.75% on 12 March; this marked the seventh consecutive meeting where rates were reduced.

- The bank announced its plan to complete the normalization of its balance sheet, ending quantitative tightening, and will restart asset purchases in early March, beginning gradually so that its balance sheet stabilizes and then grows modestly, in line with growth in the economy.

- The Governing Council noted that the economy grew more than expected in the fourth quarter of last year, spurred by past rate cuts but growth is now expected to slow at the turn of the year due to increasing trade conflict with the United States.

- Employment growth strengthened in November through January and the unemployment rate declined to 6.6%. In February, job growth stalled. While past interest rate cuts have boosted demand for labour in recent months, there are warning signs that heightened trade tensions could disrupt the recovery in the jobs market. Meanwhile, wage growth has shown signs of moderation.

- Inflation remains close to the 2% target. The temporary suspension of the GST/HST lowered some consumer prices, but January’s CPI was slightly firmer than expected at 1.9%. Inflation is expected to increase to about 2½% in March with the end of the tax break. The Bank’s preferred measures of core inflation remain above 2%, mainly because of the persistence of shelter price inflation. Short-term inflation expectations have risen in light of fears about the impact of tariffs on prices.

- While economic growth has come in stronger than expected, the pervasive uncertainty created by continuously changing U.S. tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest.

- While monetary policy cannot offset the impacts of a trade war, the Governing Council will carefully assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs.

- The Council will also be closely monitoring inflation expectations and is committed to maintaining price stability for Canadians by keeping inflation close to the 2% target.

- The next meeting is on 16 April 2025.

Next 24 Hours Bias

Weak Bullish

Oil

Key news events today

No major news events.

What can we expect from Oil today?

Oil prices edged higher on Thursday as traders assessed a tightening of crude supplies along with new U.S. tariffs and their expected effect on the world’s economy. The biggest headwind for oil right now is the concerns about trade and oil tariffs could slow demand growth, especially after U.S. President Donald Trump imposed new 25% tariffs on potential buyers of Venezuelan crude on Tuesday. WTI oil has climbed nearly 5% at its highest point this week due to fears of tighter supplies following the recent sanctions on Venezuelan oil. This benchmark briefly rose above $70 per barrel by Wednesday and then again on Thursday and is set to notch its third consecutive week of higher gains as trading comes to a close on Friday.

Next 24 Hours Bias

Medium Bullish

The post IC Markets Europe Fundamental Forecast | 28 March 2025 first appeared on IC Markets | Official Blog.

General Market Analysis – 28/03/25

414087 March 28, 2025 13:00 ICMarkets Market News

Stocks Tumble on More Tariff Concerns – Nasdaq Down 0.5%

Global stock markets fell in trading yesterday as investors continued to digest more tariffs from President Trump and potential counter-tariffs from those targeted. The three major US stock indices all fell: the Dow dropped 0.37%, the S&P 0.33%, and the Nasdaq led the way lower again, losing 0.53% by the close. The dollar took a hit, with the DXY down 0.36% to 104.28, and USDJPY noticeably pushing back to monthly highs above 151.00. US Treasury yields had a mixed day, the shorter end falling off—the 2-year down 2.7 basis points to 3.990%—while the longer-term yields pushed back to monthly highs, the benchmark 10-year up 0.7 basis points to close at 3.359%. Oil prices pushed higher again on supply concerns, Brent up 0.35% to $74.05 and WTI up 0.39% to $69.92 a barrel, whilst gold surged to another new high on the back of more market uncertainty, closing the day up 1.25% at $3,059.55 an ounce.

Gold Continues to Shine in Uncertain Markets

Gold prices surged to yet another new high in trading yesterday as market uncertainty over tariffs and a potential global trade war again pushed funds towards the world’s favourite haven product. Tariffs on automobiles from the US to a raft of countries have been the main catalyst for the move this time around, and counter-tariffs could see an escalation to a full global trade war, which could see the precious metal drive even higher. The next major hurdle for further top-side moves is tonight’s key US Core PCE data, with a higher print than the expected 0.3% increase likely to lead to some dollar buying, which could see gold levels pull back along with Fed rate cut expectations. However, the opposite is also true, and a weaker number—which could bring expectations of a Fed cut closer—could combine with geopolitical uncertainty to push gold higher faster and challenge the next big figure up at $3,100 an ounce in relatively short order.

Inflation Data in Focus Again Today

There is some major inflation data due out across the trading sessions again today, but the jury is still out on whether it will supersede the impact of geopolitical updates in the current market environment. The focus in the Asian session today will be on Japanese markets, with the release of the closely monitored Tokyo Core CPI numbers due out early in the session. Market expectation is for the year-on-year data to show a 2.2% increase, and anything significantly off this print will see strong moves in the yen. The focus will be back on UK markets at the European open, with retail sales numbers (exp -0.3% m/m) the highlight of the morning data drop. However, the major focus for the day will come early in the New York session with the release of the Fed’s favoured inflation indicator, the Core PCE Price Index. Expectation is for a 0.3% month-on-month increase, and anything off from this print will see big moves in the market. Canadian GDP numbers and revised University of Michigan data are also due out during the session, but expect the impact of the US inflation numbers to dominate sentiment.

The post General Market Analysis – 28/03/25 first appeared on IC Markets | Official Blog.

Friday 28th March 2025: Technical Outlook and Review

414082 March 28, 2025 11:00 ICMarkets Market News

DXY (US Dollar Index):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

Price could fall toward the pivot and potentially make a bullish bounce off this level to rise toward the 1st resistance.

Pivot: 104.00

Supporting reasons: Identified as an overlap support that aligns close to a 38.2% Fibonacci retracement, indicating a potential area where buying interests could pick up to resume the uptrend.

1st support: 103.22

Supporting reasons: Identified as a multi-swing-low support, indicating a potential area where the price could stabilize once again.

1st resistance: 104.80

Supporting reasons: Identified as an overlap resistance that aligns close to a 38.2% Fibonacci retracement, indicating a potential level that could cap further upward movement.

EUR/USD:

Potential Direction: Bearish

Overall momentum of the chart: Bearish

Price has made a bearish reversal off the pivot and could potentially fall toward the 1st support.

Pivot: 1.0825

Supporting reasons: Identified as an overlap resistance that aligns close to a 38.2% Fibonacci retracement, indicating a potential area where selling pressures could intensify. The presence of the red Ichimoku Cloud adds further significance to the strength of the bearish momentum.

1st support: 1.0687

Supporting reasons: Identified as a pullback support that aligns close to a 38.2% Fibonacci retracement, indicating a potential area where the price could stabilize once more.

1st resistance: 1.0885

Supporting reasons: Identified as a pullback resistance that aligns close to a 61.8% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

EUR/JPY:

Potential Direction: Bearish

Overall momentum of the chart: Neutral

Price has made a bearish reversal off the pivot and could potentially fall toward the 1st support.

Pivot: 163.17

Supporting reasons: Identified as an overlap resistance that aligns close to a 78.6% Fibonacci retracement, indicating a potential area where selling pressures could intensify.

1st support: 161.61

Supporting reasons: Identified as a multi-swing-low support, indicating a potential area where the price could stabilize once again.

1st resistance: 164.02

Supporting reasons: Identified as a swing-high resistance, indicating a potential area that could halt any further upward movement.

EUR/GBP:

Potential Direction: Bullish

Overall momentum of the chart: Bearish

Price is trading close to the pivot and could potentially make a bullish bounce off this level to rise toward the 1st resistance.

Pivot: 0.8337

Supporting reasons: Identified as an overlap support, indicating a potential area where buying interests could pick up to stage a rebound.

1st support: 0.8310

Supporting reasons: Identified as a pullback support, indicating a potential area where the price could stabilize once more.

1st resistance: 0.8377

Supporting reasons: Identified as an overlap resistance that aligns close to a 38.2% Fibonacci retracement, indicating a potential level that could cap further upward movement.

GBP/USD:

Potential Direction: Bullish

Overall momentum of the chart: Neutral

Price has made a bullish bounce off the pivot and could potentially rise towards the 1st resistance.

Pivot: 1.2876

Supporting reasons: Identified as a multi-swing-low support, indicating a potential area where buying interests could pick up to resume the uptrend.

1st support: 1.2779

Supporting reasons: Identified as a pullback support that aligns close to a confluence of Fibonacci levels i.e. the 23.6% and 50% retracements, acting as a potential level where the price could stabilize once again.

1st resistance: 1.3009

Supporting reasons: Identified as a swing-high resistance, indicating a potential level that could cap further upward movement.

GBP/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

Price could fall toward the pivot and potentially make a bullish bounce off this level to rise towards the 1st resistance.

Pivot: 194.75

Supporting reasons: Identified as a pullback support that aligns close to a 38.2% Fibonacci retracement, indicating a potential area where buying interests could pick up to resume the uptrend. The presence of the green Ichimoku Cloud adds further significance to the strength of the bullish momentum.

1st support: 193.43

Supporting reasons: Identified as an overlap support that aligns close to a 61.8% Fibonacci retracement, indicating a potential level where the price could stabilize once more.

1st resistance: 197.07

Supporting reasons: Identified as an overlap resistance that aligns close to a 127.2% Fibonacci extension, indicating a potential level that could cap further upward movement.

USD/CHF:

Potential Direction: Bullish

Overall momentum of the chart: Neutral

Price could fall toward the pivot and potentially make a bullish bounce off this level to rise towards the 1st resistance.

Pivot: 0.8797

Supporting reasons: Identified as an overlap support, indicating a potential area where buying interests could pick up to stage a rebound.

1st support: 0.8758

Supporting reasons: Identified as a multi-swing-low support, indicating a potential level where the price could stabilize once again.

1st resistance: 0.8866

Supporting reasons: Identified as an overlap resistance that aligns with a confluence of Fibonacci levels i.e. the 23.6% and 38.2% retracements, indicating a potential level that could cap further upward movement.

USD/JPY:

Potential Direction: Bullish

Overall momentum of the chart: Bullish

Price is falling toward the pivot and could potentially make a bullish bounce off this level to rise towards the 1st resistance.

Pivot: 149.48

Supporting reasons: Identified as an overlap support that aligns close to a confluence of Fibonacci levels i.e. the 38.2% and 61.8% retracements, indicating a potential area where buying interests could pick up to resume the uptrend. The presence of the green Ichimoku Cloud adds further significance to the strength of the bullish momentum.

1st support: 148.26

Supporting reasons: Identified as a swing-low support that aligns with a 61.8% Fibonacci retracement, suggesting a potential area where the price could stabilize once more.

1st resistance: 151.29

Supporting reasons: Identified as an overlap resistance, indicating a potential level that could cap further upward movement.

USD/CAD:

Potential Direction: Bearish

Overall momentum of the chart: Bearish

Price is trading close to the pivot and could potentially make a bearish reversal off this level to fall toward the 1st support.

Pivot: 1.4320

Supporting reasons: Identified as an overlap resistance that aligns with a 50% Fibonacci retracement, indicating a potential area where selling pressures could intensify. The presence of the red Ichimoku Cloud adds further significance to the strength of the bearish momentum.

1st support: 1.4237

Supporting reasons: Identified as a pullback support that aligns with a 78.6% Fibonacci retracement, indicating a key level where the price could stabilize once more.

1st resistance: 1.4383

Supporting reasons: Identified as a swing-high resistance, indicating a potential area that could halt any further upward movement.

AUD/USD:

Potential Direction: Bearish

Overall momentum of the chart: Neutral

Price has made a bearish reversal close to the pivot and could potentially fall toward the 1st support.

Pivot: 0.6327

Supporting reasons: Identified as an overlap resistance that aligns with a 50% Fibonacci retracement, indicating a potential area where selling pressures could intensify. The presence of the red Ichimoku Cloud adds further significance to the strength of the bearish momentum.

1st support: 0.6262

Supporting reasons: Identified as a multi-swing-low support, suggesting a potential area where the price could stabilize once again.

1st resistance: 0.6355

Supporting reasons: Identified as an overlap resistance that aligns close to a 78.6% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

NZD/USD

Potential Direction: Bearish

Overall momentum of the chart: Neutral

Price has made a bearish reversal close to the pivot and could potentially fall toward the 1st support.

Pivot: 0.5762

Supporting reasons: Identified as a multi-swing-high resistance that aligns close to a 38.2% Fibonacci retracement, indicating a potential area where selling pressures could intensify. The presence of the red Ichimoku Cloud adds further significance to the strength of the bearish momentum.

1st support: 0.5712

Supporting reasons: Identified as a multi-swing-low support that aligns close to a 50% Fibonacci retracement, suggesting a potential area where the price could stabilize once more.

1st resistance: 0.5783

Supporting reasons: Identified as a pullback resistance that aligns close to a 61.8% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

US30 (DJIA):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

Price could fall toward the pivot and potentially make a bullish bounce off this level to rise towards the 1st resistance.

Pivot: 42,114.80

Supporting reasons: Identified as a pullback support that aligns close to a 38.2% Fibonacci retracement, indicating a potential area where buying interests could pick up to resume the uptrend. The presence of a green Ichimoku Cloud adds further significance to the strength of the bullish momentum.

1st support: 41,410.00

Supporting reasons: Identified as an overlap support that aligns close to a 61.8% Fibonacci retracement, indicating a potential level where the price could stabilize once again.

1st resistance: 43,012.90

Supporting reasons: Identified as a swing-high resistance that aligns close to a 50% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

DE40 (DAX):

Potential Direction: Bearish

Overall momentum of the chart: Bearish

Price could rise toward the pivot and potentially make a bearish reversal off this level to fall toward the 1st support.

Pivot: 22,723.90

Supporting reasons: Identified as an overlap resistance that aligns with a 38.2% Fibonacci retracement, indicating a potential area where selling pressures could intensify.

1st support: 22,381.49

Supporting reasons: Identified as a multi-swing-low support that aligns with a confluence of Fibonacci levels i.e. the 100% projection and the 161.8% extension, indicating a key level where the price could stabilize once more.

1st resistance: 23,185.90

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

US500 (S&P 500):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

Price is trading close to the pivot and could potentially make a bullish bounce off this level to rise towards the 1st resistance.

Pivot: 5,670.70

Supporting reasons: Identified as a pullback support that aligns close to a 38.2% Fibonacci retracement, indicating a potential area where buying interests could pick up to resume the uptrend. The presence of a green Ichimoku Cloud adds further significance to the strength of the bullish momentum.

1st support: 5,603.80

Supporting reasons: Identified as a multi-swing-low support that aligns close to a 61.8% Fibonacci retracement, indicating a potential level where the price could stabilize once again.

1st resistance: 5,843.10

Supporting reasons: Identified as a swing-high resistance that aligns close to a 50% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

BTC/USD (Bitcoin):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

Price could fall toward the pivot and potentially make a bullish bounce off this level to rise towards the 1st resistance.

Pivot: 85,982.89

Supporting reasons: Identified as an overlap support that aligns with a 23.6% Fibonacci retracement, indicating a potential area where buying interests could pick up to resume the uptrend.

1st support: 81,319.71

Supporting reasons: Identified as a swing-low support that aligns with a 61.8% Fibonacci retracement, indicating a potential level where the price could stabilize once more.

1st resistance: 92,463.38

Supporting reasons: Identified as a swing-high resistance, indicating a potential area that could halt any further upward movement.

ETH/USD (Ethereum):

Potential Direction: Bullish

Overall momentum of the chart: Neutral

Price is falling toward the pivot and could potentially make a bullish bounce off this level to rise towards the 1st resistance.

Pivot: 1,949.48

Supporting reasons: Identified as an overlap support that aligns close to a 50% Fibonacci retracement, indicating a potential area where buying interests could pick up to resume the uptrend.

1st support: 1,832.10

Supporting reasons: Identified as a multi-swing-low support that aligns with a 78.6% Fibonacci retracement, indicating a potential level where the price could stabilize once again.

1st resistance: 2,132.80

Supporting reasons: Identified as an overlap resistance that aligns close to a 50% Fibonacci retracement, indicating a potential area that could halt any further upward movement.

WTI/USD (Oil):

Potential Direction: Bearish

Overall momentum of the chart: Bullish

Price could rise towards the pivot and potentially make a bearish reversal off this level to fall towards the 1st support.

Pivot: 70.34

Supporting reasons: Identified as a multi-swing-high resistance that aligns close to a 61.8% Fibonacci retracement, indicating a potential area where selling pressures could intensify.

1st support: 68.75

Supporting reasons: Identified as an overlap support that aligns with a 38.2% Fibonacci retracement, indicating a key level where the price could stabilize once more.

1st resistance: 71.86

Supporting reasons: Identified as an overlap resistance, indicating a potential area that could halt any further upward movement.

XAU/USD (GOLD):

Potential Direction: Bullish

Overall momentum of the chart: Bullish

Price could fall toward the pivot and potentially make a bullish bounce off this level to rise toward the 1st resistance.

Pivot: 3,049.75

Supporting reasons: Identified as a pullback support, indicating a potential area where buying interests could pick up to resume the uptrend. The presence of the green Ichimoku Cloud adds further significance to the strength of the bullish momentum.

1st support: 2,998.31

Supporting reasons: Identified as an overlap support that aligns close to a 38.2% Fibonacci retracement, acting as a potential level where price could stabilize once again.

1st resistance: 3,093.54

Supporting reasons: Identified as a resistance that aligns with a 161.8% Fibonacci extension, indicating a potential area that could halt any further upward movement.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.

The post Friday 28th March 2025: Technical Outlook and Review first appeared on IC Markets | Official Blog.

IC Markets Asia Fundamental Forecast | 28 March 2025

414081 March 28, 2025 10:39 ICMarkets Market News

IC Markets Asia Fundamental Forecast | 28 March 2025

What happened in the U.S. session?

The U.S. economy expanded at an annualized rate of 2.4% in the fourth quarter of 2024, slightly higher than the previous estimates of 2.3%. Exports fell slightly less and imports declined more than initially anticipated, leaving the contribution from net trade positive at 0.26 pp (vs 0.12 pp). Government expenditure also rose more while fixed investment contracted less. Meanwhile, unemployment claims printed at 224k, coming in marginally below the forecasts of 225k. Claims have remained pretty stable over the last four weeks, averaging around 223k – lower and stable claims typically highlight a resilient labour market. Despite a relatively robust set of macroeconomic data, the dollar index (DXY) slid lower toward 104 overnight as sentiment was hurt by the White House’s announcement to impose tariffs on automobile imports. U.S. President Donald Trump announced that he will impose 25% tariffs on all foreign-made cars and light trucks, effective April 2. The move is expected to ramp up local automobile costs in the near-term, as manufacturers race to find new supply chains and shift more of their production into the U.S. but the 25% tariff also heralds pain for U.S. automakers, given that a bulk of them operate factories outside the U.S., especially in Mexico.

What does it mean for the Asia Session?

Japan’s Tokyo Core CPI accelerated from an annual rate of 2.2% in the previous month to 2.4% in March, higher than the market consensus of 2.2%. This marks the fifth consecutive month that core inflation has remained above the Bank of Japan’s (BoJ) 2% target, reinforcing expectations that the central bank will continue normalizing monetary policy. The BoJ held interest rates steady during its March policy meeting as the board took a cautious stance while assessing the impact of rising global risks on the domestic economy. However, Governor Kazuo Ueda signalled this week that further rate hikes are likely if economic conditions align with projections. The yen initially strengthened following this data release with USD/JPY falling toward 150.70 but it reversed swiftly to rise steadily toward 151.20.

The Dollar Index (DXY)

Key news events today

PCE Price Index (12:30 pm GMT)

What can we expect from DXY today?

The PCE Price Index – which is the Federal Reserve’s preferred gauge of inflation – moderated lower in January as both headline and core readings eased, marking its first slowdown in four months. Should inflationary pressures continue to dissipate further in February, this recent ascend in the DXY could lose some steam during the U.S. trading hours.

Central Bank Notes:

- The Board of Governors of the Federal Reserve System voted unanimously to maintain the Federal Funds Rate in a target range of 4.25 to 4.50% on 19 March 2025

- The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run but uncertainty around the economic outlook has increased; the Committee is attentive to the risks to both sides of its dual mandate.

- Recent indicators suggest that economic activity has continued to expand at a solid pace while the unemployment rate has stabilized at a low level in recent months, and labour market conditions remain solid. However, inflation remains somewhat elevated.

- GDP growth forecasts were revised downward for 2025 (1.7% vs. 2.1% in the December projection) while PCE inflation projections have been adjusted slightly higher for 2025, with core inflation expected to reach 2.5%, partly due to tariff-related pressures.

- In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook and is prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of its goals.

- Beginning in April, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25B to $5B while maintaining the monthly redemption cap on agency debt and agency mortgage-backed securities at $35B.

- The next meeting is scheduled for 6 to 7 May 2025.

Next 24 Hours Bias

Medium Bullish

Gold (XAU)

Key news events today

PCE Price Index (12:30 pm GMT)

What can we expect from Gold today?

The PCE Price Index – which is the Federal Reserve’s preferred gauge of inflation – moderated lower in January as both headline and core readings eased, marking its first slowdown in four months. Should inflationary pressures continue to dissipate further in February, this recent ascend in the DXY could lose some steam during the U.S. trading hours, potentially providing a boost for gold prices.

Next 24 Hours Bias

Medium Bullish

The Australian Dollar (AUD)

Key news events today

No major news events.

What can we expect from AUD today?

The Aussie has hovered around 0.6300 for most of this week but downward pressures are driving it toward 0.6270 at the beginning of Friday’s Asia session. Persistent demand for the greenback will likely weigh on the Aussie as the day progresses.

Central Bank Notes:

- The RBA reduced the cash rate by 25 basis points to bring it down to 4.10% on 18 February, marking the first rate cut since November 2020.

- Financial conditions are restrictive, which is weighing on demand and is helping to bring down underlying inflation; growth in private demand has been subdued.

- Underlying inflation has moderated over the past three quarters with trimmed mean inflation easing to 3.2% over 2024 and it is expected to reach the 2–3% target range in early 2025, which is sooner than expected at the time of the November Statement.

- The unemployment rate declined a little in late 2024 to 4% with much of the strength in the labour market underpinned by strong employment growth, which has also bolstered household incomes.

- The announcement of tariffs between the United States and other major economies poses challenges to the global outlook but the scale and incidence of the tariffs and their effects remain highly uncertain – which may itself delay some investment until the outlook becomes clearer.

- Economic activity strengthened in China but growth there is still facing structural headwinds while domestic economic growth is forecast to pick up and the labour market is forecast to remain tight.

- If the cash rate follows the market path, underlying inflation is projected to be a little above 2.5% over most of the forecast period. The anticipated recovery of GDP growth and lingering tightness in labour market conditions are expected to sustain some upward pressure on inflation.

- Sustainably returning inflation to target within a reasonable timeframe remains the Board’s highest priority. This is consistent with the RBA’s mandate for price stability and full employment.

- The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions, paying close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market.

- The next meeting is on 1 April 2025.

Next 24 Hours Bias

Weak Bearish

The Kiwi Dollar (NZD)

Key news events today

No major news events.

What can we expect from NZD today?

Renewed demand for the greenback on Friday put downward pressure on the Kiwi. Overhead pressures are likely to build further as the day progresses and this currency pair could retest this week lows of 0.5700.

Central Bank Notes:

- The Monetary Policy Committee (MPC) agreed to reduce the Official Cash Rate (OCR) by 50 basis points bringing it down to 3.75% on 19 February, marking the fourth consecutive rate cut.

- The Committee assessed that annual consumer price inflation remains near the midpoint of the MPC’s 1 to 3% target band; inflation expectations are at target and core inflation continues to fall towards the target mid-point.

- Economic activity in New Zealand remains subdued and with spare productive capacity, domestic inflation pressures continue to ease. Price and wage-setting behaviours are adapting to a low-inflation environment while the price of imports has fallen, also contributing to lower headline inflation.

- Economic growth is expected to recover during 2025 as lower interest rates will encourage spending, although elevated global economic uncertainty is expected to weigh on business investment decisions. Higher prices for some key commodities and a lower exchange rate will increase export revenues and employment growth is expected to pick up in the second half of the year as the domestic economy recovers.

- Global economic growth is expected to remain subdued in the near term as geopolitics, including uncertainty about trade barriers, is likely to weaken global growth. Global economic activity is also likely to remain fragile over the medium term given increasing geoeconomic fragmentation.

- Consumer price inflation is expected to be volatile in the near term, due to a lower exchange rate and higher petrol prices. Nevertheless, the Committee is well placed to maintain price stability over the medium term.

- The economic outlook remains consistent with inflation remaining in the band over the medium term, giving the Committee confidence to continue lowering the OCR. If economic conditions continue to evolve as projected, the Committee has scope to lower the OCR further through 2025.

- The next meeting is on 9 April 2025.

Next 24 Hours Bias

Medium Bearish

The Japanese Yen (JPY)

Key news events today

Tokyo Core CPI (11:30 pm GMT 27th March)

What can we expect from JPY today?

Japan’s Tokyo Core CPI accelerated from an annual rate of 2.2% in the previous month to 2.4% in March, higher than the market consensus of 2.2%. This marks the fifth consecutive month that core inflation has remained above the Bank of Japan’s (BoJ) 2% target, reinforcing expectations that the central bank will continue normalizing monetary policy. The BoJ held interest rates steady during its March policy meeting as the board took a cautious stance while assessing the impact of rising global risks on the domestic economy. However, Governor Kazuo Ueda signalled this week that further rate hikes are likely if economic conditions align with projections. The yen initially strengthened following this data release with USD/JPY falling toward 150.70 but it reversed swiftly to rise steadily toward 151.20.

Central Bank Notes:

- The Policy Board of the Bank of Japan decided on 19 March, by a unanimous vote, to maintain the following guidelines for money market operations for the inter-meeting period:

- The Bank will encourage the uncollateralized overnight call rate to remain at around 0.5%.

- The Bank will continue its plan to reduce the amount of its monthly outright purchases of JGBs, aiming to reach about 3 trillion yen by January-March 2026.

- Japan’s economy has continued to recover moderately, with some sectors showing improvement. Exports and industrial production have remained relatively stable, while corporate profits continue on an improving trend and business sentiment maintains a favourable level.

- The employment and income situation has shown moderate improvement, with private consumption on a moderately increasing trend despite ongoing impacts from price rises.

- On the price front, the year-on-year rate of increase in the consumer price index (CPI, all items less fresh food) has been in the range of 3.0-3.5% recently. Services prices continue to rise moderately, reflecting factors such as wage increases, while the effects of cost pass-through from past import price rises have diminished.

- Inflation expectations have continued to rise moderately, with underlying CPI inflation gradually increasing toward the price stability target of 2%. The virtuous cycle between wages and prices continues to strengthen, with businesses increasingly reflecting higher costs in selling prices.

- Japan’s economy is expected to maintain growth above its potential rate, supported by moderately growing overseas economies and the intensifying virtuous cycle from income to spending, underpinned by accommodative financial conditions.

- The next meeting is scheduled for 19 June 2025.

Next 24 Hours Bias

Medium Bullish

The Euro (EUR)

Key news events today

No major news events.

What can we expect from EUR today?

The euro rallied strongly on Thursday as it rose 0.5% to climb above 1.0910. However, overhead pressures remain for this currency pair as it dipped under 1.0900 as Asian markets came online on Friday.

Central Bank Notes:

- The Governing Council reduced the three key ECB interest rates by 25 basis points on 6 March to mark the fifth successive rate cut.

- Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be decreased to 2.65%, 2.90% and 2.50% respectively.

- The Council acknowledged that monetary policy was becoming meaningfully less restrictive, easing borrowing costs for businesses and households with inflation projected to average 2.3% in 2025, 1.9% in 2026, and 2.0% in 2027, while core inflation also neared the 2% target.

- Although domestic inflation remains elevated due to delayed wage and price adjustments, wage growth is moderating.

- Economic growth forecasts were revised downward to 0.9% for 2025 and 1.2% for 2026, reflecting weak exports and investment.

- The asset purchase programme (APP) and pandemic emergency purchase programme (PEPP) portfolios are declining at a measured and predictable pace, as the Eurosystem no longer reinvests the principal payments from maturing securities.

- The ECB remains data-dependent and will adjust its policy as needed to ensure inflation stabilizes around its 2% medium-term target without committing to a specific rate path.

- The next meeting is on 17 April 2025.

Next 24 Hours Bias

Medium Bearish

The Swiss Franc (CHF)

Key news events today

No major news events.

What can we expect from CHF today?

With demand for the franc and the greenback seemingly at equilibrium since last week, USD/CHF has ranged sideways as it hovered above 0.8750 while running into headwinds at 0.8850 thus far. This currency pair looks set to extend this ‘neutral’ bias as the trading week wraps up on Friday.

Central Bank Notes:

- The SNB eased monetary policy by lowering its key policy rate by 25 basis points, from 0.50% to 0.25% on 20 March 2025, marking the fifth consecutive reduction.

- Underlying inflationary pressure has decreased further this quarter.

- Inflation in the period since the last monetary policy assessment has again been lower than expected, decreasing from 0.7% in November to 0.3% in February, primarily due to lower electricity prices.

- In the shorter term, the new conditional inflation forecast is slightly higher than December: 0.3% for Q2 2025, 0.4% for 2025 overall, and 0.8% for 2026 and 2027, based on the assumption that the SNB policy rate remains at 0.25% over the entire forecast horizon.

- GDP growth in Switzerland remains moderate, with the services sector continuing to show slightly stronger growth, while manufacturing faces challenges.

- The SNB anticipates GDP growth of around 1.0% to 1.5% for 2025.

- The SNB will continue to monitor the situation closely and will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term.

- The next meeting is on 19 June 2025.

Next 24 Hours Bias

Weak Bullish

The Pound (GBP)

Key news events today

Retail Sales (7:00 am GMT)

What can we expect from GBP today?

After declining for four consecutive months, consumer spending in the U.K. rebounded strongly in January as sales jumped 1.7% MoM, easily surpassing market expectations of a 0.3% gain. This marked the strongest expansion since May 2024, with food stores such as supermarkets, specialist food stores as well as alcohol and tobacco stores leading the gains. However, February forecast points to a decline of 0.3%, signalling a return to negative sales growth. Weaker-than-expected consumer spending could create headwinds for the pound on the final trading day of the week.

Central Bank Notes:

- The Bank of England’s Monetary Policy Committee (MPC) voted by a majority of 8 to 1 to maintain the Bank Rate at 4.50% on 19 March 2025, while one member preferred to reduce it by 25 basis points (bps).