271 | +3.357% | 3 Setups

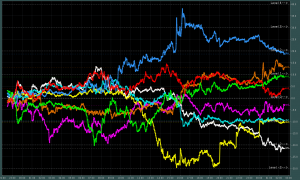

09:41 is a bit late this morning, but as it turns out, not missed that much, which however is a sign that there will be not much happening this session, probably following the moves of the US Session Yesterday. Currency Data now:

Currency Data now:

- Positive: GBP, AUD, EURÂ Â

- Negative: JPY, CAD, CHF

- Neutral: USD, NZD

- Pair(s) to Watch: AUDJPY (Buy for the news), GBPJPY (Buy)

- Asia Session Events:Â BRC Like-For-Like Retail Sales (YoY) [GBP], RBA Rate Statement [AUD]

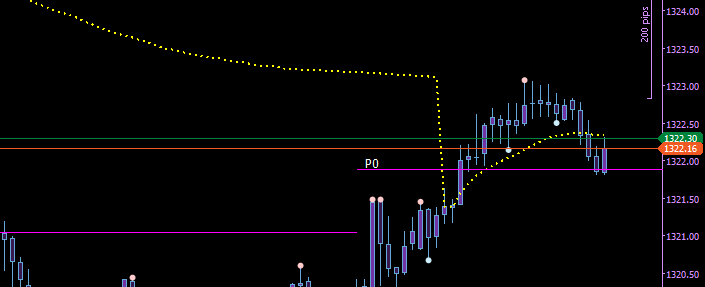

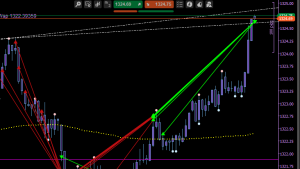

10:26 Selling Gold

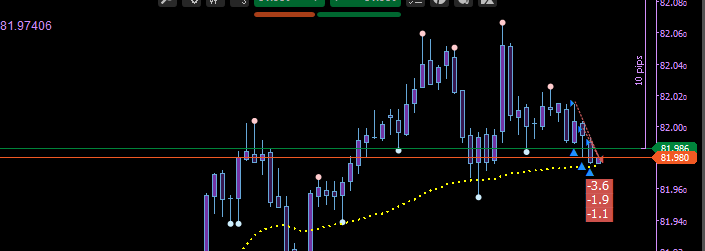

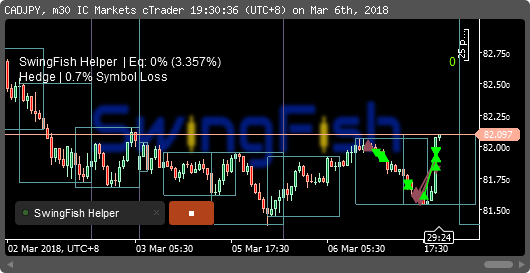

10:31Â Buying CADJPY

11:02 there will be the Australian Interest rate decision in 28 Minutes ..AUDJPY may be a Buy based on the current Divergences)

I will troll a little bit in Tradingview Forex chat about this 😉 and buy it Right now without looking at the chart.

11:23 Manually Hedging GOLD

12:13 change GOLD to Buy (1325.4 / 1328)

12:17 change CADJPY to Sell

12:57 closing all trades (AUDJPY, CADJPY, GOLD) to pay for all losses and add a small gain.

(have to step out for a moment)

14:07 re-Buy Gold (same target)

the target may out of reach as we had the 61% retracement already and we are more in a downtrend ..

will take this trade off on a minor resistance instead (unless the USDollar make some promising moves in the meanwhile)

15:11 change GOLD to SELL

15:35 Selling CADJPY to next minor Support

15:39 close CADJPY early. was just a scalp anyway (poor risk-reward) gaining 0.556%

15:42 hedging GOLD again. waiting for London open as the dollar is a bit undecided

16:25 Original TP reached on the CADJPY Short (Trendline)

16:46 re-Enter CADJPY Shorts, accidentally the position is way too large, so this got hedges VERY fast.

I will wait for some momentum to get rid of that one to make sure there is not a massive loss due to a pullback.

18:03 closed all GOLD trades on first Minor resistance. paid for all the losses so far.

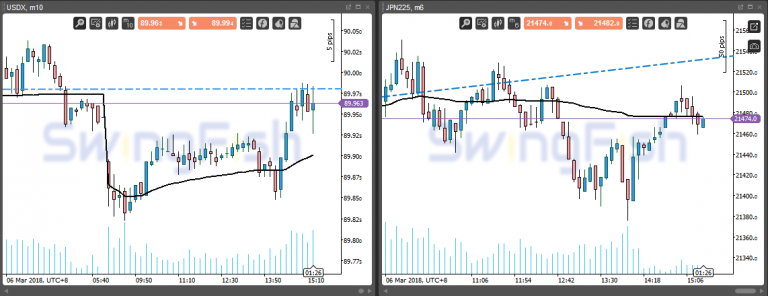

it appears the Nikkei is shooting up for no apparent reason .. so well let’s just jump that train.

19:28 reverse the CADJPY Hedge on the vWap reversal. made a massive gain due to momentum.

thanks to cTrader Trailing stop was able to catch a very large part of the move without jeopardizing the gains. a possible target would be 82.159 but with a position this size, I won’t risk a pullback.

Total Today: +3.357%

Leave a Reply