163 | +0.39% | 2 Setups

this was Day 23

Wednesday ! 5:30 .. nothing better to do …

Live Stream is not started yet .. just cleaning up the charts.

vWap is also not Reset Yet as we are “sort of Pre-Market“.

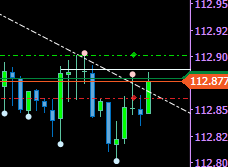

so I made a Trendline based scalp trial Short Trade on USDJPY

simply expect the price to respect the minor Trendline and the Pivot above, go Short with a Market Order based on just.

i put a smaller risk as normal on it, so i have a manually placed Hedge order above it.

### Live Stream Starts here ###

USDJPY went above my trendline, closing the trade manually with 0.11% loss.

Next on the list: EURAUD, also a Trendline based Short, but this time full size.

Which turned out about 2 minutes after to be incredible Stupid !!

as Sidney came online with a Index Gap down .. slipped my Hedge by 4.5 pips ..

floating loss: -1.43%

Guess what happened to my USDJPY trade about 5 minutes later? 😉

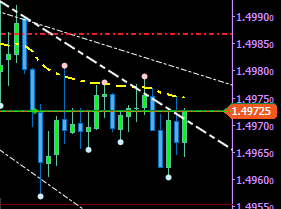

it looks a bit that AUDUSD will go up more .. however, the USDollar Index is stuck at the vWap as well .. so if it pops upwards. the trade can become quickly VERY expensive.

so I place a BUY STOP 2 pips below the double-short (42.000AUD) and a stop for the short order with a 6$ Profit. (planned hedging)

Price Reached the lower Trendline, AUDUSD also at a resistance Line plus DXY going up again.

placing a Hedge Trade with 84.000 AUD Locking the gains.

price did fall further which would have been enough to pay and get some gains, but we do not know these things before. better safe than sorry.

Price keeps falling massively, without the hedge that would have been a 17% gain. trying hard not to do anything stupid now ..

lucky I’m writing this blog, instead of jump on the boat. right after taking the screenshot above, the price started to pull back as expected.

almost 4 Hours has passed now .. the trade is still on .. holding 7.02% Equity .. (i closed 2 other hedges ripped a 8.2% hole in the Account, so as of now I am down -1.1%

Frankfurt Pre-Market had almost no impact at all.. looks like we have to wait a little bit longer.

Closing this Tuesday out with a Gain of 0.39% (Green Zero)

Leave a Reply