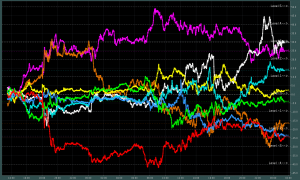

284 | +2.372% | 2 Setups

It’s Friday (again), let’s see where this session will bring us today, there were quite a number of news events while Sidney was open, causing some interesting short-term moves.

Selling Singaporean Dollars for a short range and Buy GOLD twice, where the second buy turned out not to be a long lasting trade as we found later some significant Resistance in the prices. all in all a good day, all trades went to the targets.

-

- Currency Data:

- Positive: JPY, NZD, CHF

- Negative: USD, GBP, AUD

- Neutral: EUR, CAD

- Pair(s) to Watch: GBPAUD (Buy), AUDUSD (Sell)

- Asia Session Events: European Council meeting

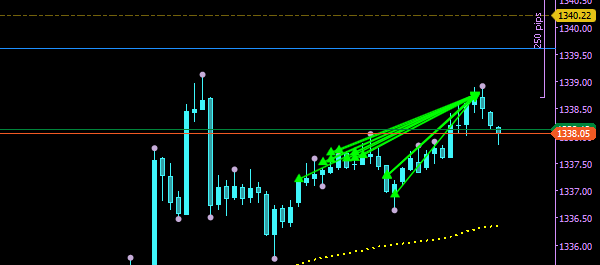

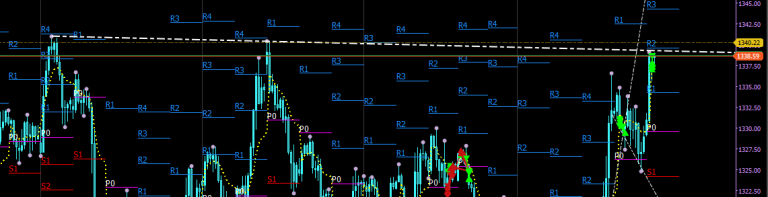

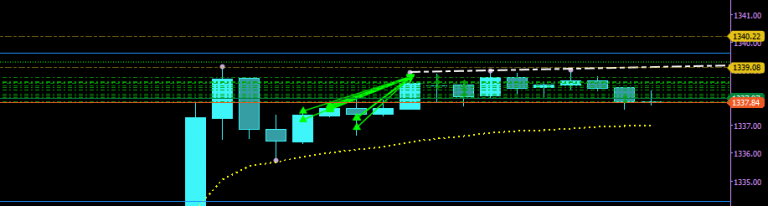

09:29 Buy Gold [1340.22, likely to exit at R2]

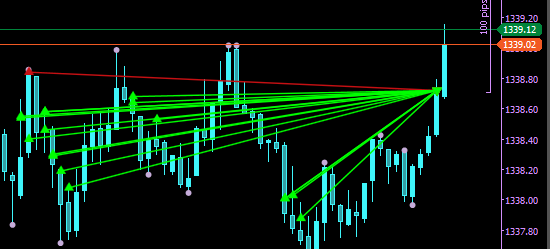

09:38 Sell USDSGD [1.31357]

10:44 Abandoning the USDSGD trade with a 0.366% gain, (i’m pretty sure it will go back down .. but the Nikkei may bounce up as we are right now on a significant Support level) so let’s just take the money at this point and not force it to the TP.

10:45 Closing GOLD Early as well as selling Volume gaining. target still can be very easy reached, but ill not risking it as we where just a few cents before it.

10:53 re-buying GOLD to R2

12:20 just discovered a quite substantial Resistance level on GOLD, will exit the GOLD Buy in a moment without waiting for the Target

12:52 will allow some larger drawdown on GOLD, to put on some more size near the vWap.

12:33 Closing All Gold Trades with asmall gain. as the risk the price will drop sharply is quite large.

Total Today: +2.372%